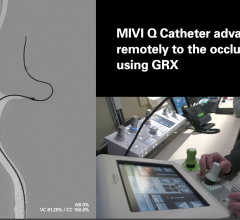

Biosense Webster's ThermoCool ablation catheter.

The incidence of cardiac arrhythmia is expected to increase significantly with an aging U.S. population and rising rates of obesity. In 2008, atrial fibrillation (AF), the most common complex arrhythmia, affected between 3 and 5 million people in the United States. To confirm the diagnosis of AF and determine the most appropriate treatment, electrophysiology catheters are often used, while cardiac ablation catheters are employed to create lesions to prevent the propagation of electrical signals that lead to certain arrhythmias.

As the technology to diagnose arrhythmias improves, we will also begin to see an increase in the diagnosis of arrhythmias. These improvements will come primarily in the form of wireless technology and software, which will allow for faster and more convenient diagnosis. This increase in the patient population will lead to a 3-4 percent annual increase in the number of patients requiring some type of arrhythmia treatment.

Industry Overview

In 2008, the total market for electrophysiology and ablation devices was valued at nearly $600 million, a 9.8 percent increase over 2007. Within this market, the fastest growing market segment was ICE (intra-cardiac echocardiography) diagnostic catheters, which are becoming more widely used in both ablation and interventional cardiology procedures. Meanwhile, the market for nonirrigated RF (radiofrequency) ablation catheters was shrinking, as physicians have been selecting irrigated ablation catheters instead. Over the next six years, the market for electrophysiology and ablation will be driven primarily by an increase in the number of procedures performed to treat atrial fibrillation. This increase will be facilitated by the FDA approval of additional products and procedures to treat this condition.

Diagnostic EP Catheters to Experience Double-Digit Growth

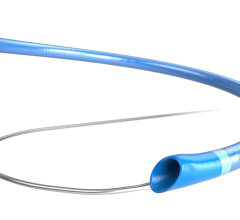

Diagnostic electrophysiology (EP) catheters are used for temporary intra-cardiac sensing, recording, stimulation, and mapping. These catheters are almost always used in conjunction with cardiac ablation procedures, although they can also be used during procedures not involving ablation, such as pacemaker, ICD, or CRT device implantation. The number of ablation procedures performed is expected to increase after 2010 due to the approval of new, minimally invasive treatments for atrial fibrillation. As a result, the overall market for diagnostic EP devices, which includes fixed curve and steerable curve diagnostic catheters, is estimated to experience double-digit growth through 2014. Steerable curve diagnostic EP catheters will be the driving force behind this growth, partly due to the adoption of relatively expensive mapping catheters.

EP Mapping

An increasing proportion of the diagnostic EP catheters used are incorporating mapping (localization) capabilities. Mapping catheters are far more expensive than their nonmapping counterparts and their popularization has led to the increases in the average selling price (ASP) of steerable catheters. St. Jude Medical has developed the NavX mechanism that allows nonmapping electrophysiology catheters to construct 3D models of the heart chamber, effectively granting them mapping capabilities. Through 2014, an ever-increasing percentage of electrophysiology catheters sold will have mapping capabilities.

New AF Ablation Devices Seek Approval

Cardiac ablation is used to treat many types of ablation, but AF is considered the most promising target because it is relatively common and does not respond well to existing treatments. In February 2009, the FDA approved the use of two ablation catheters to treat AF. The catheters were from Biosense Webster (a Johnson & Johnson company), including the NaviStar ThermoCool and the EZ Steer ThermoCool Nav. These catheters were the first to be officially approved for AF treatment in the United States, even though a number of devices were already being studied and/or sold in Europe. Prior to this approval, most cardiac ablation procedures performed to treat AF utilized catheters that were used on an off-label basis. Over time, catheters from other companies, such as Boston Scientific and St. Jude Medical, are expected to also gain FDA approval for the treatment of AF.

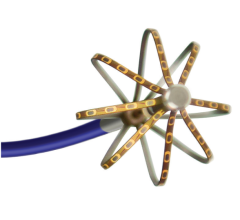

In 2008, the cardiac ablation market consisted of RF ablation and cryoablation catheters segments. The number of ablation procedures performed for the treatment of AF is expected to increase significantly after 2010, when technologies for balloon cryoablation, laser ablation, and HIFU ablation are expected to obtain FDA approval and enter the U.S. market. These devices will be geared to treating AF and their approval will contribute to a significant increase in the number of cardiac ablation procedures performed. Through 2014, the total number of cardiac ablation procedures will grow at a compound annual growth rate (CAGR) of more than 6 percent, and by 2014 will reach nearly 200,000 procedures. In addition, the percentage of all procedures accounted for by RF catheter ablations will decrease as cryoablation, laser, and HIFU procedures become more widely used.

Manual Steering to Remain Dominant

In 2008, the vast majority of catheter ablation procedures were performed using manual steering, while a much smaller percentage used remote magnetic or robotic catheter guidance. Robotic guidance, in the form of Hansen Medical's Sensei Robotic catheter system, was introduced in 2007 and since then there are relatively few robotic systems in use in U.S. hospitals. While robotic guidance offers several significant advantages, its use will remain limited due to system cost, and to restrictions on the type of catheters that can be used with it.

Magnetic navigation, using the Stereotaxis Magnetic Navigation System, has been available for several years, but the number of facilities that have had this system installed is still limited. The primary reason for this is the cost of modifying an operating room to accommodate the equipment needed. Through 2014, both magnetic and robotic guidance will become far more widely used, but manual steering will remain predominant. Guidance assistance will be used for relatively difficult procedures, such as those for treating AF.

Market for EP, Ablation Catheters

Through 2014, the market for EP and ablation catheters is expected to grow robustly, with the growth rate peaking between 2010 and 2012. This market will be driven by an increase in the number of procedures performed to treat AF, as well as an increase in the average selling price, as a result of the increasing use of expensive ICE and mapping catheters.

Competitive Analysis

Biosense Webster, a subsidiary of Johnson & Johnson, accounted for a significant portion of the cardiac ablation market, due to its large share of the RF ablation segment. Biosense is also a major supplier of diagnostic electrophysiology catheters, and is the industry leader for catheters with localization capabilities.

Boston Scientific also accounted for a large proportion of the cardiac ablation market and was the second largest competitor in the diagnostic electrophysiology device market. Boston Scientific markets its Blazer II RF ablation catheter and Ultra ICE catheter products, and frequently bundles its EP catheters with its cardiac rhythm management products. In 2008, Boston acquired CryoCor, one of the leading companies in the cryoablation field.

St. Jude Medical is another major competitor in the diagnostic electrophysiology and cardiac ablation markets. It recently acquired a number of companies in the EP and ablation field, including EP Medsystems and Irvine Biomedical. In addition to ablation catheters, St. Jude is heavily involved in the market for open surgical cardiac ablation products.

Medtronic, a leading competitor in the cardiac rhythm management market, has made significant inroads into the electrophysiology and ablation market in 2008 by acquiring CryoCath and Ablation Frontiers.

• Source: The information contained in this article is an excerpt from the report U.S. Markets for Cardiac Rhythm Management, Electrophysiology, and Ablation Devices 2008, which is available for purchase from iData Research Inc. (866) 964-3282 or [email protected]. Kamran Zamanian, PhD., is with iData Research Inc. He has disclosed that he holds no interest or securities in any company mentioned herein. Alfred Pechisker, M.Sc., is with iData Research Inc. He has disclosed that he holds no interest or securities in any company mentioned herein. iData Research Inc. (www.idataresearch.net) is an international market research and consulting group focused on providing market intelligence for the medical device, dental and pharmaceutical industries. iData covers research in categories such as: peripheral vascular, cardiovascular, CRM, dental, endoscopy, imaging, ophthalmics, orthopedics, patient monitoring, spine, urology, women's health, pharmaceuticals and more.

April 03, 2024

April 03, 2024