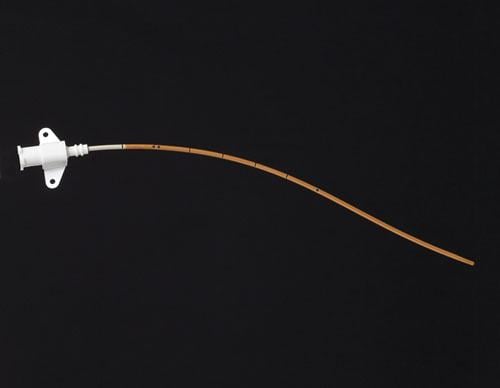

PICC lines are used for venous pressure monitoring, blood sampling, drug administration and replacement of fluids or blood products. Cook Spectrum catheters are impregnated with the antimicrobials minocycline and rifampin, which have been shown to minimize the risk of bacterial colonization of the catheter and catheter-related bacteremia during use.

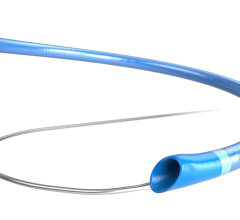

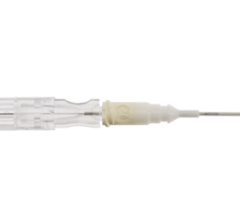

Peripherally inserted central catheters (PICCs) are devices used for intravenous access to facilitate the delivery of chemotherapy drugs, antibiotic therapies or parenteral nutrition. Typically PICCs are placed by interventional radiologists or specially trained nurses. They are inserted through peripheral veins and advanced through increasingly large veins until the catheter is properly positioned in the superior vena cava. Unlike midline catheters, which have a maximum indwell time of 30 days, PICCs can stay inside a patient indefinitely so long as complications such as inflammation of the vein (phlebitis) or catheter movement (malposition) do not arise.

Power-Injectable PICCs Innovation Brings Growth to Market

Several technological advancements occurred in the PICC market in recent years that are changing the competitive landscape and driving growth. Increasingly, medical professionals are using computed tomography (CT) imaging to guide PICCs and confirm proper placement in the vasculature. CT imaging requires the injection of a contrast media for enhanced visualization during diagnostic procedures. In order to inject this contrast media into the body, the catheter must be strong enough to withstand the pressures that can approach upwards of 300 PSI. Power-injectable PICCs are made of polyurethane instead of silicone like conventional PICCs. Polyurethane is a much stronger material than silicone, and can withstand these pressures with only a small decrease in flexibility. Even though power PICCs are more expensive than conventional models, there is a trend towards the use of power PICCs exclusively in the U.S. market.

Physicians and hospitals prefer to purchase mostly power PICCs because it offers the option to power inject if it is needed while the PICC is inserted. In 2010, approximately 70 percent of all the PICCs sold in the United States were power-injectable and by 2017, it is expected that 95 percent of devices sold will be power-injectable. Conventional PICCs will always have a niche presence in the vascular access market because of patient types who will not need a power-injection at any time and the extra cost of power-injectable PICCs is not justified.

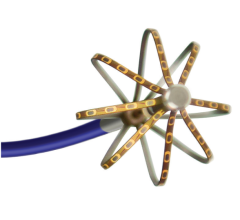

Valved PICCs Offer Flexibility During Procedures

Valved PICCs have been in the U.S. market for several years and are available for conventional and power PICCs. While power PICCs provide an additional function, valved PICCs provide a clinical benefit. A valve on the end of the catheter creates a closed system, reducing complications and the need for maintenance. Valved PICCs eliminate the use of heparin, so a saline-only solution can be used to flush the catheter. Although there are conflicting studies and opinions, valved PICCs are designed to reduce the chance of catheter occlusion. Catheter occlusion is a serious problem as it can delay or interrupt infusion therapy. If deposits of fibrin and blood components are present, the occlusion is classified as a thrombotic catheter occlusion. This can lead to catheter-related bloodstream infections (CRBSI), among many other problems. There are several types of caps and connectors on the market that can be attached to catheter hubs to facilitate needleless connections, but these devices are different from integrated valves.

Antimicrobial PICCs Lacking in Clinical Data

While antimicrobial central venous catheters (CVCs) have been available for several years, antimicrobial PICCs are still in the early stages of entering the U.S. market. The devices offer the potential for lower infection rates, but the lack of clinical data supporting these in-vitro claims has limited their growth.

Cook Medical’s Spectrum antimicrobial PICC is the first of its kind in the market and was introduced in 2009. The product uses the same minocycline and rifampin coating technology used in Cook Medical’s antimicrobial CVCs. Due to the high costs associated with infections, clinical results showing even a moderately reduced infection rate will be enough for antimicrobial catheters to successfully enter the market. Resistance is always a concern when addressing antimicrobial products and this may be cause for their delayed entry into the market. Antimicrobial PICCs will be used extensively for immunocompromised patients or those undergoing chemotherapy. Medicare reimbursement changes that eliminated reimbursement for the treatment of CRBSIs will encourage hospitals to lower their infection rates; therefore increasing the growth of antimicrobial PICCs. However, there is a lack of clinical data showing that antimicrobial PICCs improve procedural outcomes at all or even enough to justify the additional cost.

Tunneled PICCs Products Under Development

Currently, there is interest in the development of tunneled PICCs. These devices would connect to the SVC through peripheral veins like other PICCs; however, the catheter would be tunneled under the skin like a tunneled CVC. Tunneled PICCs would require implantation with an expensive surgical procedure. It would be exclusively used for patients requiring long term venous access, and the majority of the devices would likely be power injectable and single lumen. Tunneling reduces the risk of catheter infections and permanently secures the catheter in place. Tunneled PICCs offer effective substitutes for chronic CVCs and implantable ports, but with relatively low flow rates. Tunneled PICCs are still a rare practice and products are in the development phase.

Future PICC Market

Due to changes in the types of devices used and the material used to manufacture these new devices, the PICC market is expected to grow in terms of unit sales, average selling price and overall market value. Unit sales are growing because of the increased size of the patient pool due to an aging population. Growth can also be attributed to the increased use of PICCs in situations where peripherally inserted venous catheters (PIVCs) and central venous catheters (CVCs) are used due to the fact that PICCs can dwell in a body longer than PIVCs and have a lower incidence of infection.

The average selling price is increasing because of the increased use of more expensive power-injectable and antimicrobial PICCs. These two contributing factors will also lead to an expected increase in the overall market. In 2011, the U.S. PICC market was worth nearly $413 million, and over the forecast period the market is expected to experience growth every year at a CAGR of over 6 percent to reach over $583 million by 2017.

Additional Information is Available

The information contained in this article is taken from a detailed and comprehensive report published by iData Research (www.idataresearch.net) entitled “U.S. Market for Vascular Access Devices and Accessories”. This report is also available for the European and Asia Pacific regions. For more information and a free synopsis of the above report, please contact iData Research at: [email protected]

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries.

To watch a short company video, visit: www.idataresearch.net/discoveridata.html

April 03, 2024

April 03, 2024