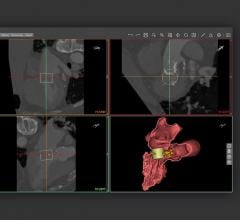

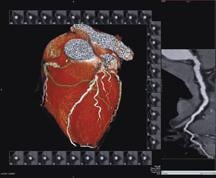

An advanced visualization of a heart created from a CT imaging study. Photo courtesy of Vital Images.

Since reimbursement codes for 3D/4D post-processing came into effect in 2007, advanced visualization is ready for widespread adoption in the U.S.

Cardiovascular Imaging Drives Growth

Mirroring the evolution of CT and MR solutions within the cardiology segment, the advanced visualization market owes the main part of its recent growth to the cardiovascular imaging markets such as computed tomography angiography (CTA). Other clinical areas such as molecular imaging using PET/CT are also promising. The clinical areas that medical imaging providers are capitalizing on are also the main areas served by advanced visualization technology.

Two Tiers of Competition

The advanced visualization industry remains divided in two tiers of competition, including independent vendors and modality OEMs/PACS vendors, who have been fueling the in-house development of 3D imaging and clinical applications for CT and MR imaging.

Market revenues continue to be divided almost equally between the two competitive tiers, with modality and PACS vendors taking advantage of easier access to the market, and independent vendors competing on technology and quality. However, the modality vendors who have traditionally sold stand-alone advanced visualization workstations tied to their CT and MR scanners are incorporating more of this functionality into their PACS platform, and similarly the general PACS industry is continually enhancing the 3D/4D capabilities of their systems beyond basic maximum intensity projection (MIP) and multi-planar reconstruction (MPR).

Enterprise Wide Deployment Drives Industry

The server-client technology that independent vendors pioneered a few years ago is becoming the de facto standard for advanced visualization, allowing access to the functionality outside the confines of the radiology reading room by clinicians other than radiologists.

Accordingly, purchasing models more flexible than the traditional seat licensing model, such as floating and unlimited licenses, are growing more popular in the marketplace, mirroring the evolution of PACS that took place during the early 2000s. The only two viable future scenarios for advanced visualization solutions are therefore either PACS integration or dedicated advanced visualization solutions deployed on enterprise servers. This clear direction undertaken by the advanced visualization market is dictating the competitive dynamics in the industry, such as marketing and R&D partnerships with PACS vendors.

May 12, 2020

May 12, 2020