Just when drug-eluting stents (DES) were going to revolutionize interventional cardiology, new reports that DES may be associated with increased risk of late-stent thrombosis have many physicians putting the brakes on DES use. Despite this significant bump in the road, stent manufacturers are forging ahead with clinical trials on novel systems and on plans to roll out new DES platforms in 2008.

Do the stent manufacturers know something the clinicians don’t? Or are they confident that re-engineering the next generation of drug-eluting stents will be sufficient to raise the bar on safety and overcome the deficiencies of their predecessors?

Safety issues put the brakes on DES

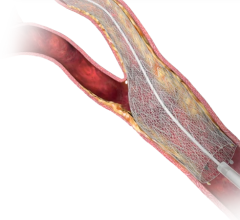

The question of safety has impacted the market since last fall with reports from federal health advisers and medical researchers pointing to research showing that patients with DES face a higher risk of heart attacks and death than patients with bare-metal stents (BMS) due to late-stent thrombosis.

One such study, published in the Journal of the American College of Cardiology (January 2, 2007), compared coronary collateral function in patients after BMS or DES implantation. The results concluded that collateral function long after coronary stenting is impaired with DES (sirolimus and paclitaxel) when compared with BMS.

“The combination of sudden arterial blockages due to a rare condition called stent thrombosis, and the absence or impairment of the self-healing mechanism of coronary collateral function, potentially leads to a larger and deadlier heart attack in patients with drug-eluting stents,” said lead researcher Christian Seiler, M.D., professor and co-chairman of Cardiology at University Hospital, Bern, Switzerland.

“Considering the protective nature of collateral vessels, this could lead to more serious cardiac events in the presence of an abrupt coronary occlusion,” the researchers concluded.

By June of this year, U.S. doctors reported implanting fewer coronary stents than any other month in the last year. According to Goodroe Healthcare Solutions LLC, which surveyed 75 U.S. hospitals with catheterization facilities for stenting, physicians used roughly 1.48 stents per procedure in June of 2007, down four percent from January of 2007, and total stent usage in the U.S. fell about 16 percent.

DES trials forge ahead

Despite the grim reports, makers of DES, including Medtronic Inc., Abbott Vascular/Guidant and Boston Scientific, predict the market will eventually recover. This attitude is readily apparent as stent manufacturers move forward with clinical trials and plans to introduce new DES platforms.

Both Abbott and Medtronic plan to introduce new stents in the near future. On July 2 of this year, Medtronic announced that a review of data from the ENDEAVOR IV Clinical Trial indicated that the trial has met its primary, noninferiority endpoint, in which patients who received the company’s product had at least comparable results nine months after the procedure as those who received Boston Scientific’s TAXUS product, the top-selling drug-coated stent in the U.S.

“If you look at the performance of the Endeavor stent in its clinical trials, which at PMA will have 4,100 patients presented, we have struck that balance of providing efficacy advantages in terms of reducing restonosis and repeat procedures, as well as providing them a stent that has demonstrated rates of thrombosis that are less than other stents on the market and on par with or better than our bare-metal stents,” indicated Robert Clarke, senior director of Public Relations and State Government Affairs, Medtronic. “We have had a zero percent late-stent thrombosis after one year in three clinical trials that we have reported on. The stent thrombosis that we did have, which were three or four, all occurred within the first 30 days.” The Endeavor stent may be cleared for sale in the U.S. before the end of this year.

Abbott recently published the results of the SPIRIT III trial, and plans to use the data to seek U.S. market approval of the XIENCE V stent. The results of study showed that the stent had minimal late loss, which was reflected by low rates of restenosis and target lesion revascularization. The successful introduction of this stent to the U.S. market, slated for the first half of 2008, is important to both Abbott and Boston Scientific. When Boston Scientific bought the bulk of Guidant, it struck a deal with Abbott to market the XIENCE stent under a different name — PROMUS — while sharing profits with Abbott.

Back to bare metal stents?

Meanwhile, other stent makers are targeting physicians who have lost confidence in DES and have returned to BMS. Cook Medical, for example, recently announced the completion of patient enrollment and six-month follow-up data in Phase II of the APPRAISAL clinical trial, which is designed to study the effect of Resten-MP in the prevention of cardiovascular restenosis when used in conjunction with the placement of one or more BMS.

“Our plan is to invest the necessary resources to commercialize AVI’s NEUGENE technology as quickly as possible for the cardiology market,” said Joseph B. Horn, president of Global Therapeutics, a Cook Medical company.

Stefan Sack, M.D., principal investigator at the University of Essen in Germany, principal investigative center, added, “We believe that the Resten-MP delivery system eliminates the potential long-term problems associated with the current drug-eluting stent systems available to physicians and patients.”

The next generation

Despite discouraging results from the last generation of drug-eluting stents, manufacturers are determined to design a better model.

The next generation of drug-eluting stents, according to Renu Vierman, M.D., CVPath International Registry of Pathology, will have different release kinetics, improved drugs with lower dosages, different and less inflammatory polymer coatings and quicker endothelialization. This is the mantra of the new stents scheduled to hit the market, including Medtronic’s Endeavor Resolute, Abbott’s XIENCE V and Boston Scientific’s Express Stent.

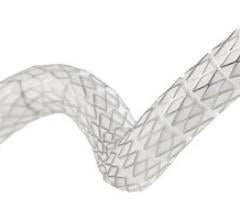

With Abbott’s XIENCE platform, the polymer is structured to release everolimus from a thin cobalt-chromium stent strut covered by a durable biocompatible fluoropolymer. It is nonadhesive, designed to avoid bonding and webbing, and the thin polymer is structured to minimize the profile of the stent and promote strut endotheliazliation.

Similarly, Medtronic’s Endeavor Resolute has focused on the polymer, which it calls a benign polymer. “The polymer is biocompatible with the vessel and doesn’t cause inflammation or negatively react with the blood or the vessel at all,” said Clarke. “It’s designed to mimic a red blood cell.” The drug will have a more sustained release profile, which Clarke says would be particularly useful for patients with extremely diseased arteries, calcified lesions and for diabetics.

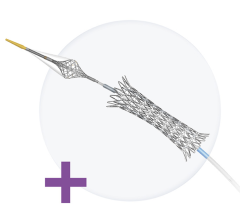

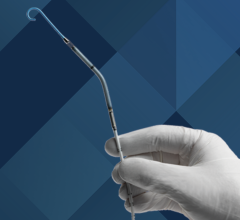

Medtronic will further modify its platform by offering both the over-the-wire delivery system and the multi-exchange or MX2 system. MX2 is a single-operator system designed to be a hybrid of over-the-wire and the rapid exchange program.

“Physicians who use rapid exchange could be motivated to adopt MX2 knowing that they have a drug-coated stent at the end of it, and a drug-coated stent that appears to have a better safety profile than the ones that are available,” noted Clarke. “We are offering a drug-coated stent with our MX2 delivery system as part of our PMA.”

A novel hybrid stent material developed by Boston Scientific, called Platinum Enriched Stainless Steel (PERSE), is engineered to increase radiopacity and strength, while remaining extremely flexible. The new material will be used in the new PROMUS Element and TAXUS Element DES platforms.

Whether these modifications to next generation DES systems will produce greater efficacy and safety remains to be seen, but there is enough optimism, at least among the manufacturers, that better days will come for drug-eluting stents and the patients they treat.

“We know there is an appetite by physicians to have more options than they have today,” said Clarke. “And they are acutely aware of the safety profiles and efficacy of those new options.”

Feature | September 09, 2007 | Cristen C. Bolan

New DES Platforms Keep Rolling Out

Next-generation drug-eluting stents offer re-engineered polymers, delivery systems and drugs.

November 24, 2025

November 24, 2025