Figure 1.

If the exhibit floor of the 99th Scientific Assembly and Annual Meeting of the Radiological Society of North America (RSNA) had one standout modality this year, it was, without question, the advances with premium computed tomography (CT). Technological and clinical advances in magnetic resonance (MR) and molecular imaging were less impressive but were no less significant. Naturally, these developments in every advanced imaging modality are turning eyes to advanced visualization (AV) and clinical applications. AV is not just a core step in the interpretation workflow of each of these modalities. More than that, it is the set of solutions that will allow the realization of the promises of these imaging advances — the ones that will “make sense” of these upgraded imaging capabilities by using innovative ways to interrogate their improved image depth and visualize their enhanced image quality.

Evolving Customer Demands From a Maturing Market

It is a fact that the value proposition of any new premium imaging system being launched in the marketplace is largely shaped by the set of existing clinical applications it helps improve and the new clinical applications it gives rise to. Increasingly, in the last few years, the market success of new premium scanners has also hinged on the availability of wide-set clinical applications modules and image analytics tools, such as quantification, computer-assisted diagnosis and image fusion.

Furthermore, market demand for having this entire solution set accessible as a single, integrated multimodality, multivendor, multiPACS, multiuser and multisite solution that can be deployed in varying “flavors” in and beyond the primary reading room is on the rise. Soon enough, the market will demand a true multidepartment solution as well, to also include, for example, all cardiovascular and oncology applications.

Continued Advances With Multispecialty Clinical Applications

CT continues to attract the larger share of research and development efforts in the AV industry, with MR in a strong second place, followed by positron emission tomography (PET/CT) and nuclear medicine, mainly represented by single-photon emission computed tomography (SPECT). Mirroring the technology and market advances of hybrid imaging systems, notably PET/CT and PET/MR, multi-modality image fusion is on the rise as well. Innovations with evermore powerful clinical application “nuts and bolts” are appearing in every clinical area where these modalities are evolving, such as radiology, cardiology, image-guided surgery, neurology, nuclear medicine, orthopedics and oncology.

Consolidation Around Five Key Industry Vendors

The industry dynamics prevailing in the United States three to five years ago pointed toward the possibility of further industry fragmentation. Many relatively new contenders were actively working to break into the market: vendors with a strong market presence in Japan, such as Aze and Ziosoft, as well as those with innovative thin client solutions, such as Visage Imaging and Calgary Scientific, to name only a few players within these then-emerging competitive tiers.

This industry fragmentation, however, did not take place in the United States as one would have thought. On the contrary, the competitive landscape for the U.S. AV market has since continued to consolidate around five major players. Namely, GE Healthcare, Siemens Healthcare, Philips Healthcare, Vital Images (now Vital, a Toshiba Medical Systems Group company) and TeraRecon have all continued to gain ground in the U.S. market while upgrading their several-hundred customer bases to their new-generation platforms.

Intensifying Competitive Dynamics Raising Entry Barriers

Today, the Japan-based vendors have not achieved the wide impact in the United States that their strength in the Japanese market suggested they might have as they were entering the U.S. market a few years ago. Ziosoft, which became Qi Imaging in 2011 yet retained the name Ziosoft in Japan, as well as Aze, have both had difficulty repeating their ongoing success in their domestic market in the U.S.

However, it is important to note Japan’s significance in the global AV market, as the country boasts the highest utilization rates of advanced imaging and number of advanced imaging equipment per capita. These varying levels of global market success are due to very different AV workflows in each region. Imaging providers in Japan, and even more so in Europe, rely on radiologists themselves to perform the post-processing manipulations using sophisticated and often cumbersome image analytics tools. Contrastingly, in the United States, much of this work is done by technologists, often as part of 3-D labs, before pushing the reconstructions and renderings to PACS for radiologist interpretation, and then billed separately.

Similarly, the other tier of contenders, including Visage and Calgary, has been much more IT-focused in recent years. They have developed and are now bringing to the market their new universal viewers, which include 3-D/4-D capabilities and are designed for enterprise-wide deployment. As such, they have been moving away, to some extent, from their former clinical focus as they used to leverage more of their limited resources to develop cutting-edge 3-D/4-D clinical applications.

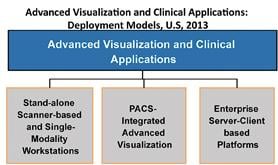

Industry-wide Alignment With Enterprise IT Deployment Models

With these ongoing competitive trends, today the market activity in the U.S. AV market can be categorized according to the IT deployment model of new systems, based on three main categories.

The first category, which symbolizes the first-generation of these systems throughout the last two decades, consists of the sale of stand-alone workstations attached to individual imaging equipment or to multiple equipment of the same imaging modality, such as multiple CT scanners.

The second category consists of AV functionality that is integrated with or embedded into PACS, generally through a partnership between the PACS vendor and one of the AV independent software vendors (ISV). Indeed very few PACS vendors, notably Carestream Health, have developed native 3-D/4-D imaging capabilities embedded into their PACS.

Finally, the third category consists of enterprise platforms based on a server-client architecture, which centralizes the heavy-lifting data processing resources on the server side instead of each individual workstation. Five years ago TeraRecon was the only vendor doing most of its business activity in this segment. At that time, Vital Images joined into the segment with its Vitrea Enterprise solution. They were followed by the three major original equipment manufacturers (OEMs) — GE, Siemens and Philips — over the last three to four years.

Blurring the Lines Between OEM and ISV

Since then, OEMs have made impressive strides developing and marketing their enterprise products, generating an increasing share of business under the third IT deployment product category, which now also includes GE’s Advantage Workstation (AW) in its server configurations, Siemens’ syngo.via and Philips’ IntelliSpace Portal.

These vendors are gradually bringing more of their clinical applications to their enterprise product in order to expand their offering, which, in general, still lacks the breadth of their thick client workstation offerings. In addition, initial research suggests that Philips has developed an edge over the other two vendors, using a single server for all three of the core imaging modalities — CT, MR and nuclear medicine — as opposed to interconnecting two or more servers to achieve a multi-modality AV platform.

While they continue to conduct a significant portion of their business activity in the first segment — leveraging new modality sales for new workstation sales — the OEMs’ recent advances with the server-client deployment model (the second and third segments) are even more significant. Today, they are able to position their enterprise product as a true vendor neutral platform, a competitive advantage once reserved to the ISVs alone.

Enabling an Open IT Ecosystem for Third-party Plug-ins

No matter how much these five core vendor products evolve and expand, it will remain virtually impossible in the foreseeable future for a single-vendor solution to be able to meet the specific requirements and preferences of every clinical end-user throughout the imaging enterprise. Therefore, these platforms are serving as a gateway, or better, as an integration engine of various plug-ins for a variety of third-party specialty clinical applications, and computer-aided detection and diagnosis (CAD).

In addition to the multitude of vendor-validated, user-driven integrations with third-party applications, the most notable recent example of this trend comes from Vital’s RSNA 2013 announcement. The company, which continues to operate largely independently since the 2011 Toshiba acquisition, yet with renewed focus on CT applications and treatment planning suggesting strong roadmap alignment with its parent company, clearly articulated this strategy based on enabling various third-party specialty applications while relying on the server-based approach to allow for a smooth workflow experience.

Under the Spotlight

The ongoing advances in the capabilities, functionality and applicability of advanced imaging equipment are bringing advanced visualization and clinical applications back under the spotlight. As it steps up to match equipment advances with application advances, the industry is moving decisively toward enterprise- and PACS-based deployment models while consolidating around five core players, yet leaving ample room for smaller specialty vendors to thrive.

Nadim Michel Daher is a principal analyst with Frost & Sullivan’s advanced medical technologies practice, specializing in medical imaging and imaging informatics. His knowledge base covers radiology and cardiology informatics and imaging equipment across modalities and information systems.

May 12, 2020

May 12, 2020