February 5, 2014 — Mercom Capital Group LLC, a global communications and consulting firm, released its annual report on funding and mergers and acquisition (M&A) activity for the healthcare information technology (IT) sector in 2013.

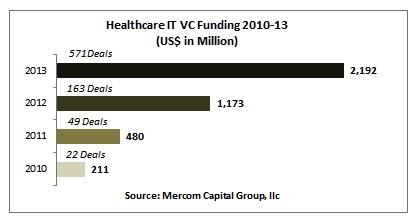

Venture capital (VC) funding in the healthcare IT sector almost doubled in 2013, totaling $2.2 billion in 571 deals compared to $1.2 billion in 163 deals in 2012. The deal count included 139 accelerator and incubator deals. The sector also raised $648 million in debt and public market financings, bringing total corporate funding raised by the sector in 2013 to almost $3 billion. VC funding dropped in Q4 2013 with $337 million in 147 deals compared to $737 million in 151 deals in Q3.

“After record fundraising totals in 2013, healthcare IT companies have now received $4 billion in venture funding since 2010,” said Raj Prabhu, CEO and co-founder of Mercom Capital Group. “Mobile health companies led the way in 2013 as the technology transformation of the healthcare industry continues.”

Overall in 2013, consumer-centric companies raised $1.1 billion. Mobile health companies were the largest recipient of VC funding, raising $564 million. Personal health companies received $198 million and social health companies brought in $166 million.

Practice-centric companies also raised $1.1 billion in 2013. Areas that received the most funding under this category were population health with $179 million, electronic medical record/electronic health record (EMR/EHR) with $166 million and practice management with $162 million.

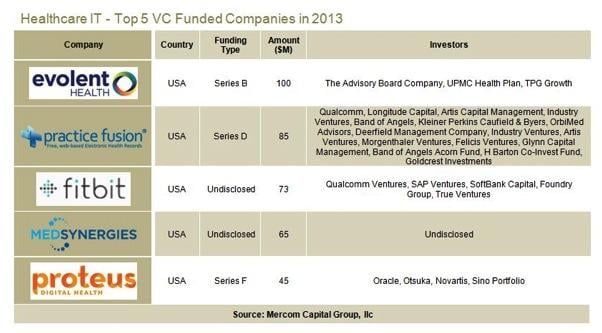

The top five VC funded companies in 2013 were:

- Evolent Health is population health management services organization, which raised $100 million. Evolent Health integrates technology, tools and on-the-ground resources to support health systems in executing their population health and care transformation objectives.

- Practice Fusion is a web-based EMR provider, which raised $85 million in two deals.

- Fitbit is a fitness and health tracker company, which brought in $73 million in two deals.

- MedSynergies is a provider of revenue and performance management solutions to healthcare providers, which raised $65 million.

- Proteus Digital Health is a provider of a digital health feedback system, which raised $45 million.

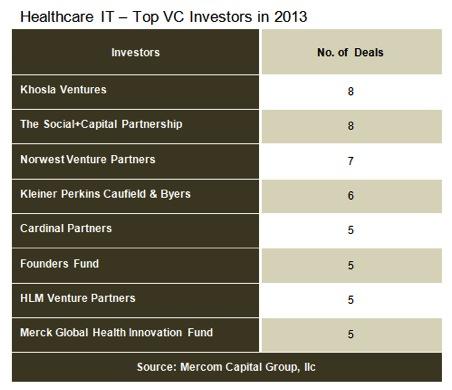

There were 466 investors involved in funding rounds for healthcare IT companies in 2013. The top VC investors were Khosla Ventures and The Social+Capital Partnership with eight deals each, followed by Norwest Venture Partners with seven deals and Kleiner Perkins Caufield & Byers with six deals.

Within the United States, California led healthcare IT fundraising with 134 deals followed by New York with 48, Massachusetts with 39, Texas with 29, and Tennessee with 26. A total of 43 states had at least one deal in 2013.

M&A activity in the healthcare IT sector remained flat in 2013, with 165 transactions compared to 163 transactions in 2012. There were 44 M&A transactions in Q4 2013. There were 16 companies that made multiple acquisitions in 2013.

Health Information Management (HIM) companies saw the most M&A activity in 2013 with 76 transactions, followed by Revenue Cycle Management companies with 25.

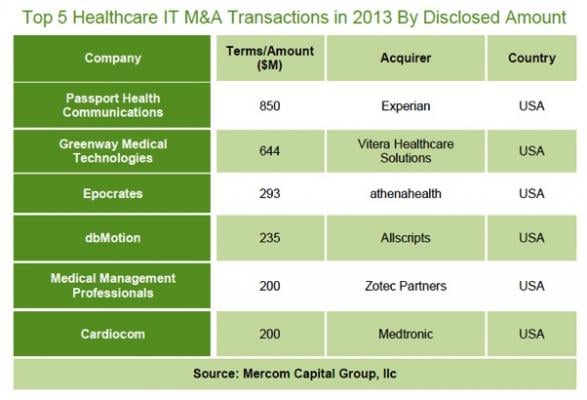

The top six disclosed M&A transactions included:

- Experian’s $850 million acquisition of Passport Health Communications. Passport Health Communications is a provider of technology solutions and services that help hospitals and healthcare organizations streamline business operations and secure payment for their services. Experian is a global information services company.

- Vitera Healthcare Solutions’ $644 million acquisition of Greenway Medical Technologies. Greenway Medical Technologies is a revenue cycle management and EHR company. Vitera Healthcare Solutions is a provider of EHR and practice management software.

- Athenahealth’s $293 million acquisition of Epocrates. Epocrates is a developer of a medical application for clinical content, practice tools, and health industry engagement at the point of care.

- Allscripts’ $235 million acquisition of dbMotion. dbMotion is a developer of a data normalization platform for multiple electronic health records.

- Zotec Partners’ $200 million acquisition of Medical Management Professionals. Medical Management Professionals is a medical billing and practice management company.

- Medtronic’s $200 million acquisition of Cardiocom. Cardiocom is a provider of integrated clinical telehealth services.

There were two healthcare IT IPOs in 2013, raising a combined total of $195 million. Benefitfocus, a provider of cloud-based benefits software, raised $131 million, and Covisint, provider of a cloud engagement platform for creating and enabling mission-critical external business processes, raised $64 million.

For more information: mercomcapital.com

March 06, 2024

March 06, 2024