The LEADERS Trial showed that the Biosensors BioMatrix, a drug-eluting stent with a biodegradable abluminal polymer coating, was functionally equivalent to a regular nonbiodegradable stent.

The interventional cardiology market includes, but is not limited to, drug-eluting stents, bare-metal stents, percutaneous transluminal coronary angioplasty (PTCA) and cutting balloon catheters. Although this market is growing overall, some segments are experiencing low negative growth and even dropping in value. Currently there are a few top competitors that hope to gain market share by bringing bioabsorbable stents into the U.S market. Some of these companies have already released bioabsorbable stents successfully in Europe. Technology is constantly improving and despite a less than smooth start, these stents are predicted to gain market share.

Bare-Metal and Drug-Eluting Stents Market

The U.S. stent market is projected to drop below $2 billion by 2019, resulting primarily from better drug management, decreased average selling prices and slowed growth in the number of angioplasty procedures. Stents remain the largest segment in interventional cardiology devices. The U.S. market for drug-eluting stents stabilized after initial concerns over the likelihood of thrombosis occurring when drug-eluting stents were used, however better drug management and decreased growth in procedure volumes will be major factors in the stent market. Within the next few years the first bioabsorbable stent is likely to be released in the United States, which could drastically change the stent market. The determining factor will be whether bioabsorbable stents become a viable alternative to drug-eluting stents or whether they fulfill a niche market.

Speculation on Bioabsorbable Stents

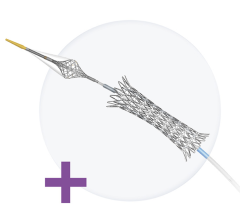

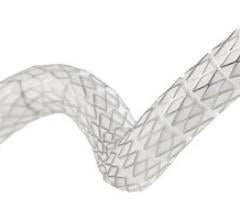

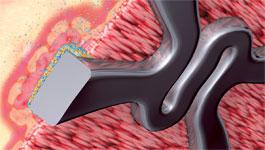

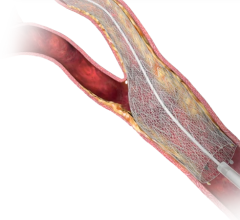

Many of the next generation of stents that are being developed utilize biodegradable polymers, which naturally degrade in the body over time. As the polymer degrades, it releases the drug contained within. Stents based on this principle are known as bioabsorbable, bioresorbable or biodegradable stents. There are a number of different polymers, drugs and other technologies that are being used by different stent developers. The main advantage of bioabsorbable stents is that after the drug is released, there will be little or nothing of the original stent remaining, thereby decreasing the incidence of late stent thrombosis. Theoretically, these stents should have low rates of both restenosis and thrombosis because a device is not present in the vessel for a long period of time.

However, bioabsorbable stents have been more difficult to perfect than initially expected. Problems with varying rates of degradation and uneven drug release have delayed the introduction of these devices into the market. As a result, the U.S. Food and Drug Administration (FDA) is requiring extensive animal and human study data before considering the approval of this type of technology. Abbott Laboratories is the leader in the bioabsorbable stent market and already has a product — the Absorb. It is authorized for sale in Europe and parts of Asia Pacific and Latin America, and is an investigational device in the United States. Abbott Laboratories has titled the Absorb as a bioabsorbable scaffold to differentiate it from existing stents as a new type of therapy. The Absorb will likely be the first bioabsorbable stent approved in the United States, but is unlikely to be available for sale for another two to three years.

In 2008, the Limus Eluted from a Durable vs. Erodable Stent Coating (LEADERS) study showed that the BioMatrix, a drug-eluting stent with a biodegradable abluminal polymer coating sold by Biosensors International, was functionally equivalent to a regular nonbiodegradable stent. While the coating is absorbed between six to nine months, the stent itself is not structurally different. Since then, Biosensors began selling this bioabsorbable stent in European markets but as of 2010, had not received approval for its sale in the United States. There is ongoing debate as to whether bioabsorbable stents will obtain a large portion of the market or whether they will occupy a specific niche. Although there are variable factors, it is expected that eventually bioabsorbable stents could become the dominant type of drug-eluting stent used in the global interventional cardiology markets.

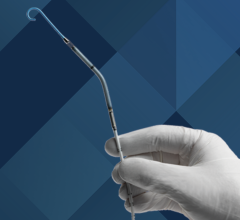

PTCA and Cutting Balloon Catheters Market

As a result of better drug management and the success of drug-eluting stents, the U.S. market for PTCA and cutting balloon catheters will experience low negative growth. PTCA balloons are used for stenting as well as pre- and post-dilations, thus the increased use of self-expanding stents, which do not require balloon catheters, continue to limit growth in this market. The market for cutting and scoring balloons will experience substantial negative growth as the volume of drug-eluting stents grows and the probability of restenosis declines.

Competitor Analysis

Boston Scientific is the leading competitor in the U.S. market for interventional cardiology. It is are a major player in the markets for drug-eluting stents, PTCA balloons, IVUS catheters, embolic protection devices and atherectomy devices. The success of Abbott Laboratories’ Xience stent significantly increased its market share in the interventional cardiology market. Following Boston and Abbott, Medtronic, St. Jude Medical and Cordis all have market shares in this segment.

Editor’s note: The information contained in this article is derived from a detailed and comprehensive report published by iData Research titled “U.S. Interventional Cardiology Devices Market.” For more information, go to www.idataresearch.net.

November 24, 2025

November 24, 2025