Evaluating the performance of your cath lab is key to developing a strategic plan for improving service offerings, planning growth and expanding market share to compete for revenues. Availability of services and strategic relationships with physicians groups are only part of the story. To gage trends in U.S. cath labs, Springboard Healthcare (a contract medical professional search services firm) conducted an industry survey in January 2012 to benchmark cath lab performance in areas of revenue, expenses, facility outlook and company culture. The purpose of the survey was to establish an index to detail industry trends, sentiment and growth prospects by cardiac cath lab leaders.

Cath lab administrators and staff members from across the nation were asked to participate in the 26-question survey. There were 359 respondents from the industry contributing to the survey results, with more than 90% representing hospital-based catheterization labs. The remaining 10% of the respondents equally represented private practice and VA/government facilities.

Within this survey are indicators that may cause some administrators to re-evaluate their strategic plan for 2012 in determining where their efforts and cath lab investments might best be utilized. Survey results show that the responses collected represent an evenly distributed sample of cath labs, with revenues ranging from less than 5 million to more than 200 million. Thereby the results discussed below are not slighted toward any particular size of cath lab, although responses were not segmented by revenue groups. The survey showed 78% of the respondents perceive the revenue trend for their facility to stay the same or improve in 2012.

Revenue Trends

Responses showed 40% of the respondents experienced increased volumes during the last three months; another 43.5% reported steady volumes while only 16.5% reported decreased volumes. See Chart 1.

Of those experiencing increased volumes:

• Half report volume increases of less than 10%

• Nearly one-third report volume increases of 10-20%

• One-eighth claim volume increases of 20-30%

• Four percent boast increases of 60%

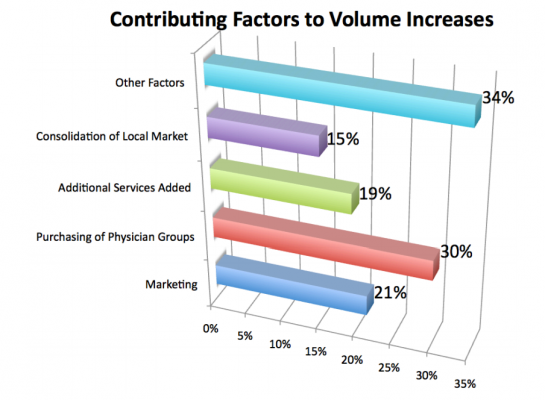

Those that experienced a loss in volume declined to quantify their decrease. Volume increases were attributable to a number of factors identified in Chart 1. Among them, physician relationships were a key contributor to volume increases claimed by the respondents. When considering written responses in the “other factors” category, nearly half of all increases were attributed to new relationships with physicians, re-engaged or redefined relationships with physicians (through purchase of physicians’ groups), or improving physician relations.

Physician relationships are having a large impact on volume increase because the reimbursements from Centers for Medicare and Medicaid Services (CMS) to cardiologists are down and the overhead is up. This has led to accountable care organizations (ACO) involvement in cath lab operations.

Other Contributors to Volume Increases

Respondents clari?ed “other factors” as including:

• Expanding current services

• Creating new or strengthening physician relationships

• Seasonal increases (for winter destination locations)

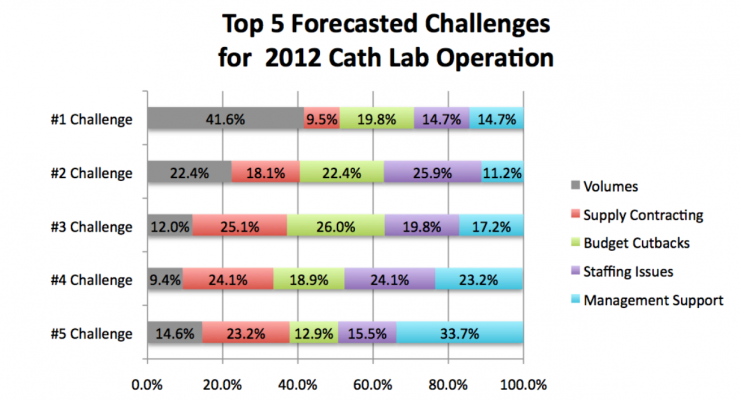

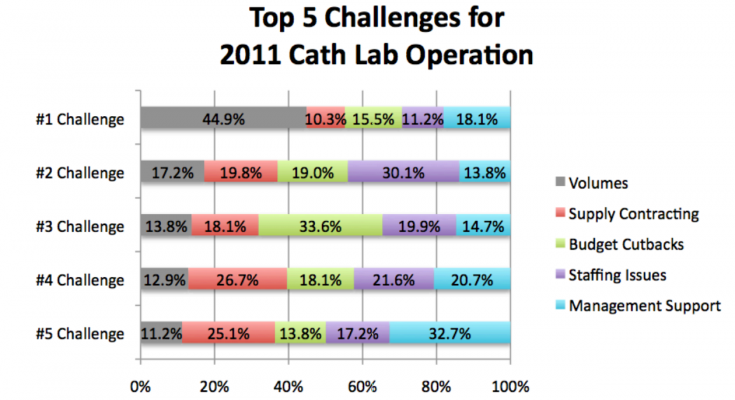

Volume continues to be the primary challenge in cath lab operations. Volumes were ranked the No. 1 challenge during 2011, and are forecasted to remain the No. 1 challenge for cath labs in 2012 by survey respondents. The contributing factors identified in Chart 2 may provide a road map when prioritizing efforts to capture additional market share.

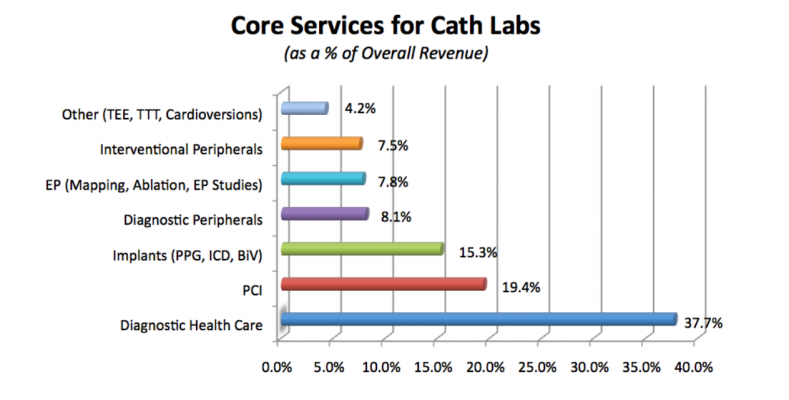

Revenue Sources

Among the revenue sources for cath labs, diagnostic health catheterization claimed to be the leading core service (as a percentage of overall revenue), representing 37.7% of all revenue generation and accounting for nearly double the revenue share of the next closest revenue contributor (percutaneous coronary intervention, or PCI). When a cath lab is evaluating its short-term strategic plan for capturing market share, see Chart 2 to see what respondents claim about the revenue contributors in their labs.

Although expenses are quickly quantifiable on monthly statements, hospitals will only realize the expense of cath lab service offerings when there is not enough margin to expand with new capabilities that your hospital may need.

Managing cath lab expenses is an instrumental component of grabbing additional market share. If you are not driving costs down and increasing margins through supply chain initiatives, you are giving up your ability to make capital investments in new capabilities or expand current services. Knowing what your competitor is paying is good information to have. How does your cath lab rate with the cost indicators below?

Cost of Supplies

When buying drug-eluting stents and dual-chamber pacemaker systems, the survey asked, “How much are you paying?” Respondents said:

Cost of Drug Eluting Stents:

• 40.2% paid less than $1,500

• 41.9% paid $1,500-$1,700

• 19.1% paid more than $1,700

Cost of Dual Chamber Pacemaker Systems:

• 22.3% paid less than $4,000

• 13.2% paid $4,000-$4,250

• 14.9% paid $4,250-$4,500

• 10.7% paid $4,500-$4,750

• 15.7% paid $4,750-$5,000

• 23.2% paid $5,000 or more

Service Offerings, Capital Expenditures

Knowing where to invest can ensure future volumes for your cath lab. When asked about service offerings, 23.1% of our survey respondents said they would be inclined to expand the current services of their cath lab, 53.7% want to expand the cath lab with (new) additional services, and 23.1% would not change the service offerings at all.

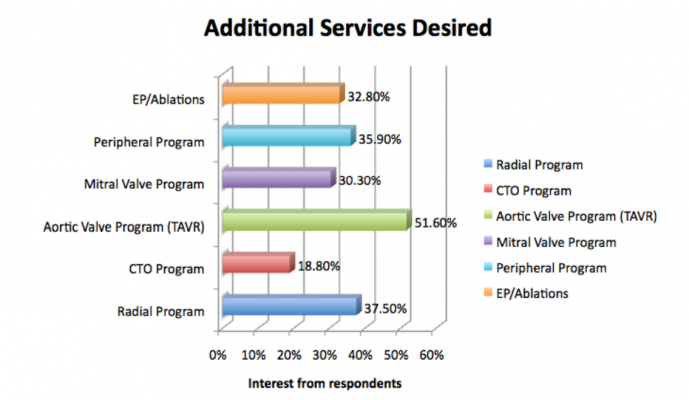

Of those that want to expand with additional services, 51.6% would like to add a transcatheter aortic valve program (TAVR). Other services that labs would like to offer to increase volume include electrophysiology ablations, peripheral artery interventions and radial access to enable same-day discharge programs. For other desired service expansions, see Chart 3.

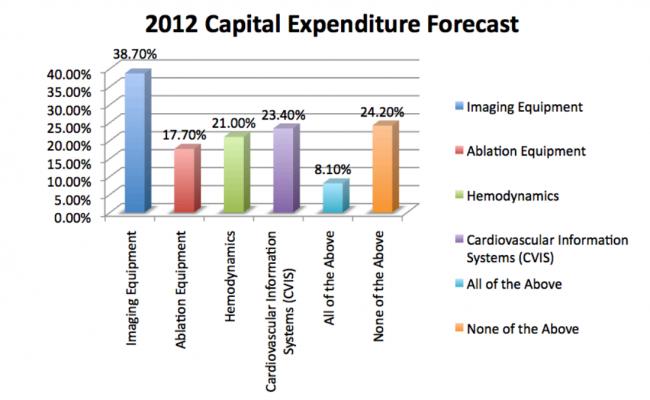

Survey respondents indicated that 2012 investments in capital equipment for their lab would be made in imaging systems, cardiovascular information systems (CVIS), hemodynamics systems and ablation systems. See Chart 4.

Volumes were ranked the No. 1 challenge for cath labs during 2011 and are forecasted to remain the No. 1 challenge in 2012, followed by staffing issues (No. 2), and budget cutbacks (No. 3).

Cath Lab Culture

The survey showed 72.1% of respondents were satisfied with their current position and working environment. Of those that indicated dissatisfaction, the respondents indicated that they are pursuing one or more of the following courses:

• 45.4% are pursuing more education

• 15.1% are considering a new career in another field

• 36.4% are considering opportunities in other cath labs

• 39.4% are pursuing another opportunity

• 9% are looking to retire

• 86.9% of the respondents feel good about the morale in the workplace, listing it as “good/improving or excellent” and attribute positive morale to direct management support. Having a staff voice to give input or mutual respect and positive relationships with the physicians was also a contributing factor to good morale.

Although our survey indicates strong support from cath lab managers and directors, it also found the perception of support from management fades at the VP and CEO levels.

Those that felt the morale was less than good attributed that to being understaffed, having poor communication or overutilization of the call team. Reduced hours/overtime was also noted as detracting from good morale.

When working with physicians in the cath lab, 70% describe the working relationship to be exceptional or working well. A large majority of the dissenters feel that there is room for improvement but stop short of describing the relationships as disrespectful.

2012 Survey Summary

In an otherwise rocky economy, the cath lab industry is perceived as stable by industry professionals. Morale remains high, and although volume continues to be the largest concern for cath lab operations, contributing factors for volume growth are clearly discernible.

As future data becomes available to compare and contrast the benchmarked areas of revenue, expenses, company culture and facility outlook, it is our goal to mark industry trends and shifts through the active participation of industry leading professionals.

Editor's note: SpringBoard provides contract medical travel professionals and search services to hospitals, doctors offices, outpatient clinics and other ancillary service providers throughout the United States. SpringBoard is Joint Commission-certified and specializes in providing quality talent to the cath lab, electrophysiology and interventional radiology niche. They serve customers from their headquarters in Phoenix, Ariz. For more information, visit www.springboardstaffing.com.

May 02, 2025

May 02, 2025