Boston Scientific's Apex PTCA dilatation balloon catheter. In 2012, Boston Scientific was the market leader in the PTCA and cutting balloon market, with more than half of the market share.

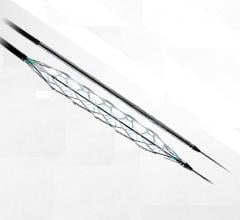

Percutaneous transluminal coronary angioplasty (PTCA) balloon catheters were the first devices used in the field of interventional cardiology. The growth of the stent market, which is the largest segment for interventional cardiology devices, has helped to fuel the sales of PTCA balloons. In addition, this market is driven by U.S. Food and Drug Administration (FDA) policy, pre-/post-stent dilations and plaque debulking.

PTCA and Cutting Balloon Catheters Market

The total U.S. market for PTCA and cutting balloon catheters was valued at $293.5 million in 2012. The PTCA balloon segment accounted for close to 90 percent of the total coronary balloon catheter market, with cutting balloons accounting for the remaining portion. The PTCA balloon catheter market is expected to increase over the next few years, and the cutting balloon market is expected to experience a slight decrease. The number of percutaneous coronary intervention (PCI) procedures is the primary market driver as a moderate decrease in the average selling price of devices is expected. There are several market drivers.

Changes in FDA Policy

In 2010, the FDA downgraded standard balloon-tipped angioplasty catheters from Class III medical devices to Class II devices with special controls. This means that companies can now bring balloon catheters to market through the 510(k) clearance process rather than the premarket approval (PMA) process. A 510(k) device only needs to prove that it is similar enough to a previously approved device in order to receive FDA approval. The PMA process requires either a clinical trial or additional laboratory studies in order to receive FDA approval and is a much longer process than 510(k). This influences the market such that companies will be able to receive clearance for their devices faster and will be more likely to attempt to enter this market because of the shorter, less expensive approval time. This change in policy has the potential to significantly alter the competitive landscape and drive product innovation through increased competition.

Pre-/Post-Stent Dilations

The majority of PTCA balloon catheters are used to dilate a vessel before inserting a stent. Concerns about late-stent thrombosis have also had a positive effect on the number of pre-stent dilation procedures preformed. Additionally, PTCA balloon catheters may be used for confirming proper deployment and placement of self-expanding stents, and their increased use during those procedures is also having a positive effect on unit growth.

Calcified Plaque Busting

Cutting and scoring balloons are used as an auxiliary method for plaque debulking. These devices have small blades or abrasive surfaces attached to the balloon in order to aid in the dissection of calcified lesions. While cutting balloons are predicted to gradually represent less of the total coronary balloon catheter market over the next few years, they have expanded the number of cases that can benefit from their use, which has had a positive effect on unit sales.

Competitor Analysis

In 2012, Boston Scientific was the leading competitor in the total PTCA and cutting balloon catheter market, with more than half of the market share. The company continues to dominate the cutting balloon catheter market with its Flextome product. It has leveraged its leading position in the drug-eluting stent market in order to negotiate combined contracts with hospitals and group purchasing organizations (GPOs). Other competitors include Abbott Laboratories, Medtronic, AngioScore, Cordis, Atrium Medical and Volcano Corp.

Editor’s note: The information contained in this article is derived from a detailed and comprehensive report published by iData Research titled “U.S. Interventional Cardiology Devices Market.” This is part of a series of publications by the same title for Japan and 15 European countries. For more information, visit idataresearch.com.

June 13, 2024

June 13, 2024