A complex PCI case to revascularize a chronic total occlusion (CTO) at Henry Ford Hospital in Detroit. Complex PCI and CHIP cases are increasing patient volumes in the cath lab and using a minimally invasive approach in patients who otherwise would have been sent for CABG. Pictured is Khaldoon Alaswad, M.D. (right) who is proctoring a fellow in treating CTOs.

Coronary artery disease (CAD) is a multifaceted disease that demands various approaches in terms of diagnosis and treatment options. Devices for the diagnosis and treatment of CAD can be of high volume and low cost or of a relatively low volume and high cost. The U.S. interventional cardiology market, worth over $2.8 billion, is currently being influenced by changes in interventional and diagnostic procedures, as well as technological innovation and consolidation.

Stabilized Angiography and PCI Volume

Growth of the interventional cardiology market is highly correlated to annual fluctuations in two procedure types — diagnostic angiography and percutaneous coronary intervention (PCI). These procedures have recently experienced a turnaround, from decline to growth, over the past few years.

Although relatively new computerized diagnostic techniques, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), provide a more detailed visual assessment of coronary arteries, angiography remains the gold standard for diagnostic coronary procedures and will continue to be used for the detection of CAD for the foreseeable future. As a result, associated device markets, such as diagnostic catheters and diagnostic guidewires, will continue to grow.

PCIs, also known as coronary angioplasties, are one of the main treatment options for CAD and typically involve the use of a coronary balloon catheter and a coronary stent. With the volume of PCI procedures in the United States estimated at more than 950,000 per year and rising, there will be positive growth in many associated device markets, such as interventional catheters, interventional guidewires and various other devices used per procedure. This is good news, considering that PCI procedure volumes, as well as coronary balloon and stent sales, have experienced substantial declines for several years following multiple clinical studies that presented evidence of over-stenting. However, procedure volume has recently stabilized, and growth is expected to continue, due to the emergence of a new area of opportunity — complex PCI cases.

New Focus on Complex PCI Patients

An increased focus on complex PCI patients will drive continued growth in total PCI procedures. Furthermore, the development of specialized devices and treatment techniques for patients that would otherwise be treated with coronary artery bypass graft (CABG) surgery, or be medically managed, is also pushing the market forward. Examples of such specialized devices include specialty balloon catheters and atherectomy devices.

A particular area that manufacturers and physicians believe is not being fully addressed by interventional techniques is the complex and higher-risk indicated patient (CHIP) population. A CHIP case is typically defined as a patient that has both complex CAD and a left ventricular ejection fraction (LVEF) of 35 percent or lower. For the purpose of this study, complex CAD is defined as having one or more of the following: Chronic total occlusion (CTO), sub-total occlusion, bifurcation, multi-vessel disease (MVD), in-stent restenosis (ISR) and left main disease. Continued advancement within this area will drive growth of segments such as CTO catheters, atherectomy devices, cutting balloons, scoring balloons and embolic protection devices. IVUS and OCT are diagnostic imaging technologies that will also benefit from progress in the complex PCI space.

Read the article "How to Tackle Coronary CTOs."

IVUS and the Growth in OCT Adoption

IVUS and OCT are some of the most focused-upon technologies within the interventional cardiology market because of the important benefit they provide in assessing complex PCI cases. Both IVUS and OCT are used in pre-stenting applications when cardiologists assess how to treat complex lesions, and in

post-stenting applications to ensure successful stent deployment. The two intravascular imaging modalities are considered competing techniques and are not commonly used together.

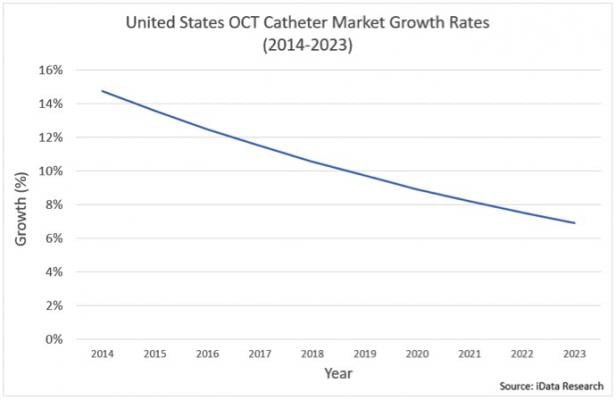

The OCT market was significantly limited in the past, due to unfavorable reimbursement conditions relative to IVUS. However, in January 2017, the professional component or physician payment was added to the cost of OCT procedures, which was previously only applicable to IVUS procedures. As a result, adoption of the technology is expected to increase in the future.

Although IVUS is used in a notable portion of PCI procedures performed in the United States, penetration is much greater in other regions, such as Japan, where IVUS is used in over 80 percent of procedures. Adoption of IVUS will be limited by the growth of OCT adoption, but is expected to increase in conjunction with complex PCI procedures.

Transition Towards Office-Based Cath Labs

Recently, there has been a change in the setting of where PCI procedures are performed. Historically, an overwhelming majority of PCI procedures were performed in the hospital setting. Unfavorable changes to reimbursement in the hospital and ambulatory surgery center (ASC) settings have contributed to a marked shift towards the office-based lab (OBL) outpatient setting. Assuming that reimbursement continues to favor the OBL setting, the segment will continue to increase its share of the procedure volume and overall market opportunity. Other benefits that OBLs provide include improved patient outcomes, greater accessibility for remote regions and the option to become accredited as a hybrid

OBL-ASC center. Continued innovations in interventional cardiology technology will allow OBLs to treat more complex cases in the future, though the majority of complex PCI cases are still performed in the hospital setting.

Consolidation, Bundling and Other Notable Trends

Similar to other medical device markets, a major factor impacting the interventional cardiology market is the consolidation seen in recent years. Large competitors are either entering the market for the first time or expanding their reach through strategic mergers and acquisitions. One trend that has arisen as a result of consolidation is the bundling of devices at a discount, which drives a decline in ASPs. Some of the major segments affected by this include stents and balloon catheters, which have both experienced steady price declines in recent years, as can be seen in the below chart on the bare-metal stent market.

In addition to these changes, another important factor affecting the market is the exit and entrance of participating companies.

Abbott and Boston Scientific both exited the bioresorbable stent market following the adverse results of clinical trials and subsequent controversy regarding the safety of the devices. In contrast, Tryton Medical received FDA approval for the first dedicated bifurcated stent in 2017, which is exclusively distributed by Cardinal Health.

These factors make the U.S. interventional cardiology market an important one to watch closely over the coming years. As the existing technology and market players face pressure from a variety of different angles, it will be interesting to discover who can adapt to the changes and capitalize on the opportunity.

Read the article "What Trends are Ahead in Cardiovascular Medicine in 2018?"

Editor’s Note:

Artur Kim is a Research Analyst Team Leader at iData Research. He was the lead researcher for the study on the U.S. Market Report Suite for Interventional Cardiology Devices 2018 – MedSuite referenced in this article. Artur has led many research studies, including custom consulting projects for cardiovascular markets, orthopedics markets and others.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry where he focuses solely on the medical, dental, and pharmaceutical industries.

iData Research is an international consulting and market research firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries. iData covers research in: interventional cardiology devices, cardiac surgery, cardiac rhythm management, peripheral vascular, orthopedics, dental, diagnostics and much more.

Reference:

U.S. Market Report Suite for Interventional Cardiology Devices 2018 – MedSuite, iData Research

November 14, 2025

November 14, 2025