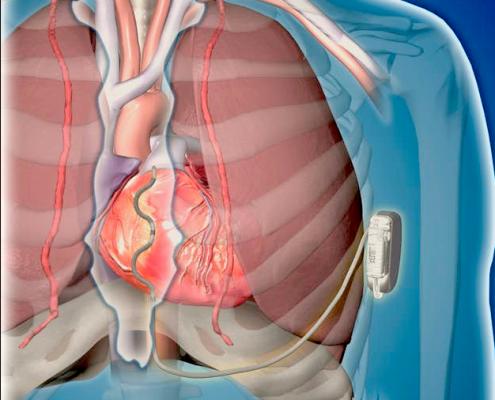

Data from the first-in-human use of Medtronic's extravascular ICD (EV-ICD) system was presented at HRS 2019.

The Heart Rhythm Society (HRS) 2019 Annual Scientific Sessions represent an important annual event for electrophysiology (EP) and for the healthcare industry at large. After all, electrophysiology, which addresses atrial fibrillation (AF) and other common heart conditions, is among the fastest growing and most expensive in the hospital’s portfolio of service lines. In fact, according to the Millennium Research Group, the U.S. EP mapping and ablation device market is expected to more than double between 2014 and 2024. It is, therefore, not a surprise that healthcare technology leaders, as well as leading physicians from around the world, are investing a lot of time and resources in EP and in the annual event where the opportunities and challenges of this growth area are addressed.

Here are my top observations at the Heart Rhythm 2019 meeting:

A Lack of Big News From Big EP Manufacturers

As usual, most of the interest from conference participants was focused on the half of the exhibit floor that housed the largest EP manufacturers. There were few announcements at the the Heart Rhythm meeting from the large manufacturers.

In its exhibit space, Biosense Webster was featuring last year’s Carto Vizigo bi-directional guiding sheath designed for use with the company’s Carto 3 system in the U.S. The device has electrodes built into the steering mechanism of the sheath. It was introduced last year to help EP physicians reduce radiation exposure and fluoroscopy dependency. Vizigo is a part of Biosense Webster’s integrated platform of technologies.

Biosense Webster's QDot Micro catheter QDOT-FAST first in-human multicenter study of the device was presented in sessions. The new catheter facilitates high power-short duration radiofrequency (RF) ablations. It demonstrated safety and efficacy in achieving pulmonary vein isolation in patients with symptomatic drug-refractory paroxysmal AF.

Abbott, which also has a mapping platform with a large footprint in the market, was focused on its Advisor HD mapping catheter, which was also launched last year. Its electrode configuration for high-density mapping is widely received as an exciting innovation.

From Boston Scientific and Medtronic, there were no large, new product unveilings on the Heart Rhythm expo floor.

A first-in-human pilot study of Medtronic's investigational Extravascular Implantable Cardioverter Defibrillator (EV ICD) system was presented in sessions. It showed the system can be implanted without major complications, and can sense, pace and defibrillate the heart without the use of trans venous leads.

New Challengers to the Top Players

There were some interesting challenges to the dominance of the largest four manufacturers, Biosense Webster, Boston Scientific, Medtronic and Abbott (St. Jude), which own the vast majority of the market for diagnostic and ablation technology in EP. Last year, Philips acquired EPD Solutions, a cardiac mapping and navigation system. This year, the company featured this mapping system on the exhibit floor.

Philips really does not have any EP catheters in its portfolio, but appears to be positioning itself as a mapping system provider for ablation catheter maker Medtronic. The companies announced at HRS 2019 they will jointly bring to market the novel KODEX-EPD cardiac imaging and navigation system. Philips said it will have cryoablation-specific features to enable electrophysiologists to perform cryoablation procedures with reduced need for X-ray imaging.

Philips has been building a portfolio of interventional cardiology catheter device technologies and started building an EP lead management product portfolio with the purchase of Spectranetics in 2017.

Another interesting challenge to the dominant players came from Acutus Medical and its development of a full EP solution on an open platform. It was interesting to see the amount of attention Acutus received from both technologists and clinicians, especially because it sounds like Acutus’ approach combines focus on clinical efficacy and operational efficiency, something that is sorely needed in EP. The FDA cleared a new version of the Acutus system in April 2019.

VIDEO: Demonstration of the AcQMap High-resolution EP Mapping System

Too Little Focus on Economics in Electrophysiology

It will be interesting to see if the above market challengers and the concepts of open platforms and a focus on EP efficiency will have any real impact in electrophysiology. As much as the great EP technologists have launched innovations that have revolutionized how U.S. healthcare can deal with atrial fibrillation, those same technologies are placing cost pressure on hospitals that makes it hard to ensure the patient access and cost efficiency that enable the results the technologies promise. Many EP labs are struggling with device costs and their impact on EP procedures, and I heard that device costs are frequently more than 60 percent of Medicare procedure reimbursement.

When hospitals struggle with the math due to the high cost of new innovations, fewer patients will ultimately have access to the benefits of those new technologies. In EP, the clinical success of scientific advancements is directly related to the cost pressure hospitals experience. At HRS 2019, I spoke with a few healthcare economists who shared the sense that the future success of EP has to come with new technologies that are not just better, but also reduce procedure time, enable hospitals to cut costs and, of course, produce better patient outcomes. When walking the exhibit floor with this in mind, very few solutions, products or services were geared to solve the economic side of this problem.

EP Catheter Reprocessing Progress on Display

Single-use device reprocessing is one solution that can enable the adoption of new EP technologies without bankrupting EP labs or excluding patient access. Device costs can be reduced by some 30 percent in an atrial fibrillation case through reprocessing. Full disclosure, I work for a reprocessing company, but what I would really like to see is legacy EP manufacturers factor in the need for EP labs to focus on procedure efficiency and cost reductions in their new technologies.

In the meantime, At HRS 2019, Innovative Health presented the seven new FDA reprocessing clearances it has received since Heart Rhythm Society last year, and Stryker announced its first new EP device reprocessing clearance in six years at the conference. So, there are promising signals that EP labs will continue to see cost reductions that enable their EP service line to remain profitable.

All the HRS 2019 late-breaking studies

Editor’s note: Lars Thording, Ph.D., has a background in academia, consulting and industry leadership. He has been responsible for the launch of numerous market-disrupting solutions across healthcare, insurance and technology. Originally from Denmark, Lars has taught at universities in Denmark, Ireland and the United States. He currently serves as the vice president of marketing and public affairs at Innovative Health, a medical device reprocessing company specializing in electrophysiology and cardiology technology. Lars currently serves on the board of the Association of Medical Device Reprocessors.

December 19, 2025

December 19, 2025