Atrial fibrillation (AF) is a precursor to a number of serious cardiovascular complications, including stroke. The increasing prevalence and cost of treating these cardiovascular complications has prompted the medical community to take a closer look at treating AF, and as a result, device treatment of the condition is expanding by leaps and bounds.

Since the medical community has begun to focus on AF in earnest in recent years, the condition, its diagnosis and treatment have received substantial attention from the medtech industry. Many leading vascular firms have identified AF ablation as an area for growth opportunity. Manufacturers such as St. Jude Medical and Medtronic have begun earmarking funds toward research and development, as well as marketing efforts focusing on AF ablation technologies.

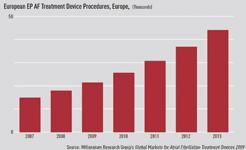

The introduction of advanced technologies – such as electrophysiology (EP) ablation catheters – will help capitalize on the growing physician demand, as will the expanding, treatable patient population. Adoption of these premium-priced technologies will fuel revenue gains at a double-digit rate in the coming years in the global AF market. Many devices often gain approval in Europe before entering the United States. This means European market performance can act as a bellwether for device performance in the larger U.S. market, despite the regional differences in adoption between the two markets. The European market for AF devices, and particularly for EP ablation catheters, is set to grow robustly over the next several years. The combined markets of France, Germany, Italy, and the United Kingdom will skyrocket from a 2008 value of over $50 million to reach more than $130 million by 2013.

Treating Atrial Fibrillation

Pharmaceuticals have long been the go-to treatment for AF, but devices are coming into their own as valid second-line options. EP catheter ablation in particular is gaining favor as a minimally invasive therapy, particularly since the technology has the ability to cure AF, rather than just manage its symptoms with pharmaceuticals. During EP catheter ablation, the physician guides an ablation catheter through the patient’s vasculature into the heart. Once properly positioned, the catheter is maneuvered to make contact with the faulty cardiac tissue. By delivering energy to the target site the tissue is destroyed, curing AF.

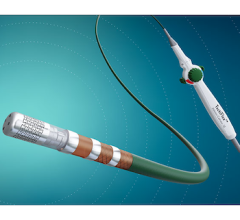

The treatment’s efficacy has proven popular across Europe, particularly in Germany, where physicians have been quick to adopt EP catheter ablation. A predominant growth driver in the coming years will be the continued launch of increasingly sophisticated technology. Newer devices aim specifically to treat the condition in a safer and more effective manner. For example, recently released devices include those that treat specific anatomy (pulmonary veins), as well as remote steering systems that allow physicians to more accurately target faulty tissue. Advanced AF ablation devices that have been released in Europe include Biosense Webster’s NaviStar ThermoCool irrigated-tip ablation catheter, Medtronic’s Cardiac Ablation System RF ablation catheter, and Arctic Front cryoballoon, and C.R. Bard’s HD Mesh, an RF ablation catheter specifically developed for AF treatment. As manufacturers prepare for U.S. launches over the coming years, they will no doubt be watching European market adoption patterns.

Certain barriers will, however, restrict the growth of advanced EP ablation catheter revenues in Europe. Most limiting will be facility financial stress. European hospitals tend to be budget constrained in the best of times, and thus the fallout from the credit crisis and the resulting economic recession has hit hospitals hard. Since many of the advanced EP ablation devices command a premium price, payers at hospitals will be reluctant to purchase these devices. Further cost-cutting measures will prompt hospitals to resterilize and/or reuse EP ablation catheters. In Germany, where procedure numbers are the highest of all countries covered, the impact of device reprocessing will be particularly felt.

Limits to Market Growth

Also limiting the revenue growth is the cost-constrained reimbursement environment in Europe. Attempts to curb costs by cutting reimbursement will force price erosion in all four countries, with cuts most visible in France and Germany. Despite reimbursement issues, in Italy and the U.K. procedures will grow very quickly, as physicians in those countries have more readily adopted AF catheter ablation.

Procedure growth will plateau by around 2011, however, as the treatable patient population shrinks.

Vendors in the Market

Established and emerging manufacturers are all looking for a slice of share in the European EP catheter ablation market. Biosense Webster, leader of the global EP AF treatment device market in 2008, focuses exclusively on the EP device space. As a pioneer of many advanced technologies in the EP catheter ablation market, such as 3D mapping and irrigated-tip radiofrequency (RF) catheter ablation, the company has established a solid reputation.

Medtronic also has a strong presence in the EP ablation catheter market, although it has a limited selection of advanced products. The company’s advanced EP ablation solution, the Sprinklr irrigated-tip RF ablation catheter, is offered in Europe. In early 2009, Medtronic announced the formation of its AF Solutions franchise, which aims to develop AF ablation therapies that are simpler and faster to perform compared to current procedures.

St. Jude Medical has identified the AF treatment device market as a key growth opportunity, and EP devices are high-profile products for the company. Historically, St. Jude Medical has diversified its EP product portfolio through the strategic acquisition of companies such as Endocardial Solutions, Irvine Biomedical, and most recently in the second quarter of 2008, EP MedSystems. The company is focusing its efforts on developing products that simplify procedures and reduce risk of complications. It plans to expand its offerings in the EP diagnostic and ablation catheter markets.

Other competitors in the European market include C.R. Bard and Boston Scientific, as well as a number of nontraditional vascular companies such as Siemens Healthcare and Philips Healthcare. Given the growing number of firms competing in this field, the struggle for share will intensify in the coming years.

Editor’s note: This article was contributed from Millennium Research Group (www.MRG.net), a Decision Resources Inc. company (www.DecisionResourcesInc.com), is the global authority on medical technology market intelligence and the leading provider of strategic information to the healthcare sector. The company provides specialized industry expertise through syndicated reports, ongoing Marketrack projects, customer loyalty tracking, facility-level procedure forecasting, and customized solutions.

January 22, 2026

January 22, 2026