With all eyes on rising healthcare costs, reprocessing of single-use devices has become an increasingly important strategy for finding efficiencies within the medical supply chain, thereby opening up life-saving procedures to more patients. But there is more to be done. Going into 2020, more manufacturers of medical devices are evaluating how the integration of catheter reprocessing considerations into their technology development can benefit patients, hospitals and manufacturers alike. The

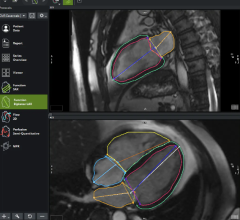

cardiac cath lab and the

electrophysiology (EP) lab is the front line in this developmentfor catheter reprocessing.

Single-use device reprocessing has been around for a while. First, hospitals routinely collected expensive devices labeled “single-use” and reprocessed them through their sterile processing departments. Then, FDA regulated the practice, and since 2000, the reprocessing of single-use devices has been restricted to a few highly regulated companies with the regulatory and technological wherewithal to restore single-use devices to their original functionality.

Today, reprocessing is getting a lot of attention, not just from hospitals freeing millions of dollars a year in reprocessing savings, but from manufacturers who see reprocessing as a means of changing the game and giving them a substantial competitive advantage. Here is why:

1. Over the years, single-use device reprocessing has proven to provide expensive devices to hospitals without losing functionality or compromising patient safety – at half the price. This has allowed per-procedure costs to go down dramatically, and manufacturers have seen the impact on their sales of new devices.

2. The medical device industry has been – and is – dominated by very few players. In the cardiology space, these are Biosense Webster (Johnson & Johnson), St. Jude (Abbott), Medtronic and Philips. They are all pushing out incrementally better technologies every year that promise better outcomes at a higher cost. This is not sustainable for hospitals that are not seeing CMS reimbursement rates going up at the same pace, and the space is ripe for disruption, both clinically and financially.

3. Due to the inherent conflict of interest, manufacturers have seen their effort to retain high new device sales countered by hospitals’ efforts to reduce the same by utilizing reprocessed devices. This has created conflict and threatened the traditional romance between manufacturer rep and doctor. This has often disabled hospitals’ ability to make their own operational and financial decisions.

4. If a vendor is not the market leader in this space and they are looking for a way to break through big-manufacturer dominance, the ticket is better technology. But these days, given the simple math of service line procedures, vendors do not even get to buy the ticket unless they have a price advantage. Reprocessing devices brings about that price advantage by reducing per-procedure costs even when new devices are more expensive.

The Legacy Conflict of Manufacturers Not Being Interested in Device Reprocessing

By definition, original manufacturers hate reprocessing. Reprocessors pick up their used devices, reverse engineer the technology, and get FDA protection to bypass the sales process and steal new device sales by undercutting prices by 50 percent. It is a bitter pill for the manufacturer sales rep, but it is a win for the reprocessor and the hospital.

For the past two decades, manufacturer reps have been trying to fight this dynamic by advancing a series of myths to undercut the value of reprocessed devices, in spite of FDA’s establishment of a rigorous process and a track record for reprocessed devices that show no difference in functionality and no added patient risk. These myths include questioning the calibration of sensors without which an FDA clearance would never have been granted, manufacturer rep discrepancy in training on technology that has been deemed to be functionally similar and more. In addition, original manufacturers have added design features that block reprocessing for no clinical reason.

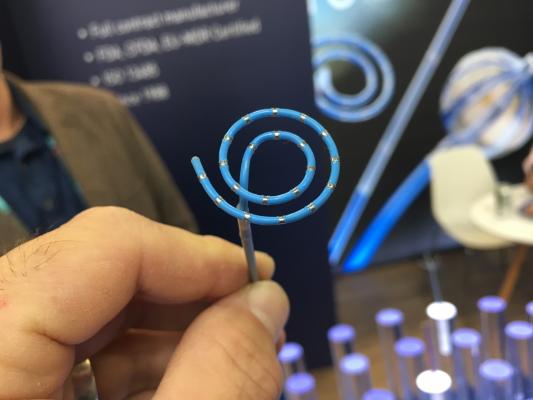

In the EP lab, entrepreneurs and innovators are looking at reprocessing with different eyes.

Atrial fibrillation (AFib) is one of the fastest growing diagnoses in healthcare. Technology is sophisticated, but still renders 50 percent (roughly) of cases unsuccessful. Lots of patients who could benefit from the procedure are not treated and instead go on medication. Lots of patients are treated, but not cured.

While the problem is inadequate technology and lack of established physician practice, the concrete roadblock is costs: Device costs amount to more than 60 percent of CMS reimbursement, so many hospitals do not open the service line. Those that do have to limit procedures to cases where a fast, positive outcome is guaranteed. Utilizing reprocessed devices means that device costs can be lowered by 30 percent and could allow hospitals to open up procedures for more patients. The dilemma for hospitals right now is that manufacturer technical support staff is backing off from supporting cases where reprocessed devices are used, robbing EP and cath labs of thousands of dollars in savings per case.

A New Perspective on Catheter Reprocessing

Here is how manufacturers are now looking to reprocessing as a solution rather than a problem:

1. Integrating a reprocessing offering into a new technology may enable a competitive manufacturer to penetrate the market faster by offering a combined portfolio of reprocessed and new devices. This drives down per-procedure costs and generates faster penetration because new technology is combined with a price advantage.

2. Partnering with a reprocessing company may enable a new manufacturer to offer reduced pricing on established technologies to reduce per-procedure costs on competing procedures as an offset to the cost of new technology.

3. Integrating reprocessing technology into the development of new technologies may enable a disruptive manufacturer to make new devices that are “reprocessable,” or designed to make savings a “part of the package.”

I work with a reprocessing company, and we are talking with original manufacturers almost every week. To break through with technology that “moves the needle,” one must have technological innovation go hand in hand with device economics that allows for better care for more patients. Otherwise, it does not count and manufacturers are starting to recognize this.

To fully understand the current medical device complex around reprocessing, it helps to ask fundamental questions: If a device can be reprocessed, why is it labeled “single-use”? Why are manufacturers not trying to design devices that are solid enough to be re-used? Why haven’t manufacturers integrated reprocessing technology into their offerings so they can gain market share and hospitals can save money? My industry, in essence, is a market imperfection made possible by the market dominance of large manufacturers. With the current interest in reprocessing, maybe it is time to define a new category of devices: “reprocessable devices.” These devices would be manufactured to be reprocessed by advanced reprocessing companies (not the hospital’s sterile processing department) or the manufacturers themselves.

In cardiology and EP, the math does not work when procedure success is poor. EP and cardiac cath labs are losing money on most cases. There is a need for industry disruption, and while the legacy players are not moving past protecting their profits, the emerging industry is getting there. Watch for major developments over the next years to change status quo.

Editor’s note: Lars Thording is the vice president of marketing and public affairs at Innovative Health LLC.

Related article:

November 14, 2025

November 14, 2025