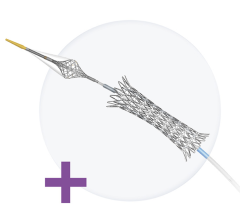

The Abbott Absorb was the first totally bioresorbable stent cleared for clinical use in the world. It gained European CE mark clearance in early 2011.

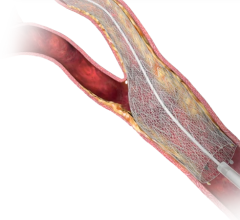

For decades, stents have been used in coronary and peripheral procedures in Europe and the United States to prevent or counteract narrowing and blocking of vessels due to disease or injury. While the use of stents has been successful, they are not without drawbacks and concerns. Restenosis, or the reoccurrence of vessel narrowing after an interventional procedure, is a common side effect resulting from the body’s natural response to a foreign object in the vasculature. New developments in drug-eluting stents, such as biodegradable materials and bifurcated stents, are expected to prompt an increase in market value. The U.S. market for interventional cardiology in particular is expected to reach almost $5 billion by 2017, with increasing drug-eluting stent sales and the emergence of bioabsorbable and bifurcated stents fueling market growth. Companies like Biosensors and Abbott are developing biodegradable and bifurcated stents to deal with concerns about thrombosis caused by long-term device implantation and to expand the type of treatable lesions, including those located at vessel branches.

Strong Growth Expected for Bioabsorable Stents in Europe, United States

Abbott’s bioresorbable Absorb stent became the first in the world cleared for commercial use in Europe earlier this year. It is estimated that bioabsorbable stents will quickly capture a significant share of the stent market.

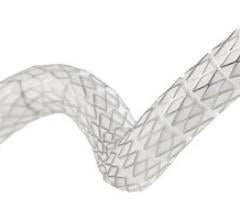

Bioabsorbable stents utilize biodegradable polymers, which naturally deplete in the body over time. As the polymer degrades, the drug contained within is released. The main advantage of bioabsorbable stents is that after the drug is released, there is little or nothing of the original stent remaining, thereby decreasing the incidence of late stent thrombosis. However, bioabsorbable stents have been more difficult to perfect than initially expected. Problems with varying rates of degradation and uneven drug release have delayed the introduction of these devices into the market. Extensive animal and human study data have been requested in both Europe and the United States before this type of technology is approved.

The penetration of bioabsorbable stents will be limited by a lack of long-term safety data and the fact that their expected average selling price (ASP) will be much higher than traditional stents. However, it is expected the unit sales of bioabsorbable stents will build at a compound annual growth rate (CAGR) of more than 145 percent in Europe through 2017. These devices are expected to enter the United States by 2013, but with a higher penetration rate, reaching almost $750 million by 2017. As a result, this market will be one of the major drivers of growth in annual sales of the interventional cardiology market.

Biosensors, Abbott, ART Emerge as Bioabsorable Stent Competitors

In 2008, Biosensors International’s BioMatrix stent was CE mark approved. Since then, Biosensors has begun selling this bioabsorbable stent in Europe on a very limited basis. Results from the Limus Eluted for a Durable versus Erodable Stent Coating (LEADERS) study showed the BioMatrix stent was functionally equivalent to a non-biodegradable stent.

In 2007, Abbott started the first phase of their A Bioabsorbable Everolimus-Eluting Coronary Stent System for Patients with Single De-Novo Coronary Artery Lesions (ABSORB) trial, which has generated three years of positive clinical data. In 2010, Abbott published the short-term results from the second phase of the ABSORB trial, which showed a low rate of major acute coronary events (MACE) and no evidence of the formation of thrombus or the need for a repeat procedure. The second phase of this trial was still ongoing in Europe in 2010, with the final results expected by 2013.

Additionally, Arterial Remodeling Technologies (ART) is developing a bioresorbable stent based on a lactic acid polymer. Stents made from this polymer have been shown to trigger only a minimal response from the artery they support, limiting the amount of restenosis. In 2010, ART’s bioabsorbable stent remained in the trial phase in Europe.

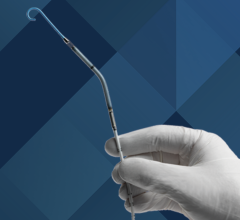

Bifurcated Stents to Enter the U.S. Market by 2012, European Market Sees Double Digit Growth

In 2010, a number of bifurcated stents were under development. However, few were being sold in Europe and none were being sold in the United States. Bifurcated stents are designed to facilitate stenting of bifurcated lesions found in coronary vessels and are expected to enter the U.S. market by 2012.

The first bifurcated stents to be approved are expected to be bare metal stents, with drug-eluting bifurcating stents requiring an additional one to two years to gain approval. Bifurcated stents will take time to penetrate the U.S. market due to their complexity and the overall lack of awareness by medical professionals. Additionally, the expected price of a bifurcated stent will be 30 percent higher than the equivalent conventional stent, resulting in the entry of several competing drug-eluting bifurcated stents into the market by companies wishing to profit from the new technology. Over time, this price difference is expected to narrow and the bifurcated market is expected grow at a CAGR of more than 70 percent through 2017.

Bifurcated stents are available on a very limited basis in Europe. However, through 2017, the European market is expected to grow at a CAGR of more than 42 percent.

One competitor in this segment is Medtronic, whose bifurcated stent has been involved in studies to assess the safety and durability of the device. Additionally, Tryton Medical was attempting to treat bifurcated lesions through the development of stents designed for side branches instead of stents with a bifurcated design. Advancements to the bifurcated stent market will further drive growth in the interventional cardiology market.

Additional Information is Available

The information contained in this article is taken from three detailed and comprehensive reports published by iData Research (www.idataresearch.net) entitled “European Markets for Interventional Cardiology Devices 2011, U.S. Market for Interventional Cardiology Devices 2011 and Global Physician Survey on Stents, Stent-Grafts and Vulnerable Plaque Treatment 2011.” For more information and a free synopsis of the above reports, contact iData Research at: [email protected]

iData Research is an international market research and consulting firm focused on providing market intelligence for the medical device, dental and pharmaceutical industries. For more information, visit www.idataresearch.net.

November 24, 2025

November 24, 2025