The Edwards Sapien valve receive FDA clearance in November 2011. However, the FDA is is putting strict limitations on who can perform implantations and which patients can receive them.

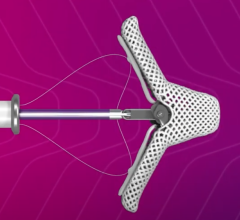

Transcatheter aortic valve repair (TAVR) — also commonly referred to as transcatheter aortic valve implantation (TAVI) — involves delivering a tissue heart valve by catheter to replace a diseased valve and is specifically targeted toward patients with severe aortic stenosis or calcification. TAVR devices have been available in Europe since Edwards Lifesciences and Medtronic received CE mark for the Sapien and CoreValve TAVR devices in 2007. Within the United States, the anticipated approval and launch of TAVR has received considerable attention, with speculation about who will perform the procedure. For example, many physicians are advocating a need for cardiac surgeons and interventional cardiologists to collaborate and work together as this technology becomes available in the United States.

(Editor's note: The Sapien valve received FDA clearance in early November 2011, soon after this article was published.)

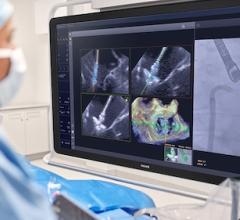

This hope for collaboration is formally demonstrated in the expert consensus document published by the American College of Cardiology (ACC) and the Society for Thoracic Surgery (STS) in June 2011. In the document, Holmes and Mach [1] present arguments advocating that TAVR be performed in specialized centers, with a multidisciplinary team of cardiologists, cardiac surgeons, interventional cardiologists, echocardiographers, imaging specialists and heart failure specialists. They say it should be performed in either a hybrid operating room (OR) or a modified cardiac cath lab. The adoption of TAVR in the United States over the coming years and months will be followed by a great deal of interest regarding who is involved in the decision-making process, who performs the procedure and where is it performed.

On July 20, the U.S. Food and Drug Administration (FDA) Circulatory System Devices Committee was tasked with voting on three questions concerning the safety, efficacy and risks compared with the benefits of Edwards Lifesciences Sapien device. The FDA voted positively on all questions [2]; the vote was based on the results from the inoperable Cohort B arm of the PARTNER trial. Cohort B demonstrated that in patients deemed ineligible for surgery, TAVR was found to be superior to standard therapy and was associated with significantly lower rates of death from any cause, including death from cardiovascular causes at one year. [3] During the July 20 FDA panel meeting, the definition of an inoperable patient received considerable attention, with four of the 10 panel members supporting a notion that would require two cardiac surgeons to state whether or not a patient can be considered inoperable.

Although the FDA is not bound by the decision of the panel, it typically follows the panel’s recommendations. Edwards Lifesciences anticipates U.S. release of the Sapien valve by the end of 2011, and the decisions made on the panel help to keep the company on track to meet that goal. The introduction of this product will expand the treatable patient pool for heart valve devices, allowing currently untreatable patients to receive the benefits of a new valve. As a result, the release of this device will significantly expand the U.S. heart valve device market.

Edwards Lifesciences is working to gain approval of the Sapien for patients with severe aortic stenosis who are considered inoperable for open heart aortic valve replacement by a cardiac surgeon. The FDA advisory panel changed the wording to incorporate the idea that patients must be symptomatic and that the transcatheter valve should be implanted in a native valve. These specifications demonstrate the panel’s focus on maintaining control over TAVR’s entry into the U.S. market. By specifying the valve must be a native valve, the agency is attempting to prevent any valve-in-valve procedures.

Competitive Landscape

The anticipated approval of the Edwards TAVR device will significantly expand the treatable patient population. It also represents a significant market opportunity for Edwards, as its biggest competitor, Medtronic, is not anticipated to receive FDA approval for its CoreValve device until 2014 [4]. This provides Edwards Lifesciences with an expected one- or two-year lead as the sole TAVR device vendor in the United States.

This first-to-market advantage will enable Edwards to train physicians with its device. Many physicians prefer to use a device they are comfortable with because they have passed the learning curve, so this will enable Edwards to have a head start. Edwards Lifesciences has made significant investments in physician and facility training, using the knowledge gained from the commercial release in Europe. It anticipates 150-250 sites — in addition to the 25 PARTNER trial sites — to be trained for the Sapien launch [5].

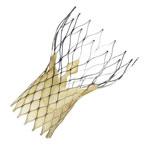

Medtronic is anticipated to be the second company to enter the U.S. market. CoreValve is currently undergoing U.S. clinical trials. The first implant for the trial occurred in December 2010 and more than 1,400 patients are expected to be enrolled in the trial, which anticipates a primary completion date in May 2013. The CoreValve trial will examine both the transfemoral and subclavian implantation routes in patients at high risk for aortic valve surgery.

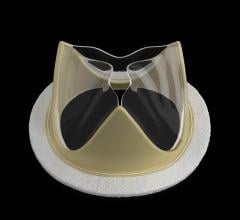

An advantage to CoreValve is the smaller 18 French delivery profile, compared to the larger Sapien valve. However, Edwards Lifesciences 18 French Sapien XT valve is anticipated to gain FDA approval in 2013 or 2014. This is around the same time as the expected clearance of Medtronic’s CoreValve, so any advantage Medtronic might have with its smaller delivery profile could depend on the timing of the release of the Sapien XT. It is likely that many Sapien users will simply transition to the Sapien XT, which happened in Europe.

European Perspective

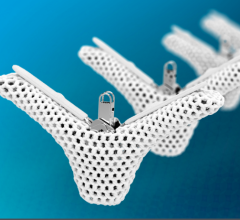

In Europe, where both companies have competed since 2007, the companies split the $230 million TAVR market almost equally. However, market dynamics are expected to change in the coming years as new competitors enter the market with next-generation devices. Physicians are looking for new devices that reduce paravalvular leakage and provide precise positioning, repositionability, retrievability, improved sealing and a smaller delivery profile with a sheath size of less than 18 French.

Large cardiovascular companies such as St. Jude Medical and Boston Scientific are working to enter the market. Both anticipate the commencement of CE mark trials in the latter half of 2011. In addition, several new players — JenaValve, Direct Flow Medical and Symetis — all anticipate embarking on CE mark approval trials in 2011 and could enter the market as early as 2012. These next-generation devices focus on improving placement of the device, and it is suggested this will decrease the need for pacemaker implantation. In addition, next-generation TAVR devices should help to decrease complication rates and could further expand the TAVR market, with devices being implanted in younger patients over time.

Whether these smaller companies are picked up by large companies remains to be seen. This space does have a history of acquisition: Medtronic entered the market through its acquisition of CoreValve and Ventor Technologies in 2009, and Boston Scientific acquired Sadra Medical and its Lotus valve in 2010.

The success of these emerging competitors in Europe will likely determine which companies work to enter the U.S. market. Large multinational companies such as St. Jude Medical and Boston Scientific have an advantage over the smaller companies because they have an established relationship with cardiologists and an extensive sales and distribution network.

St. Jude announced the first human implantation of its Portico valve in June, Boston Scientific (the Lotus valve) in April 2010. However, if one of the emerging companies is able to demonstrate results showing purported benefits of their devices, in terms of reducing paravalvular leakage, repositionability, stroke rate or delivery profile, any of them could capture market share. Edwards and Medtronic will need to continue to innovate to maintain their market shares.

Editor’s note: Millennium Research Group (www.MRG.net), a Decision Resources Inc. company (www.DecisionResourcesInc.com), is an authority on medical technology market intelligence. It provides specialized industry expertise through syndicated reports, ongoing Marketrack projects, customer loyalty tracking, facility-level procedure forecasting and customized solutions.

References:

1. Holmes D, Mack J. “Transcatheter valve therapy: A professional society overview from the American College of Cardiology Foundation and the Society of Thoracic Surgeons.” Journal of the American College of Cardiology

2. Wood S. “Sapien TAVI device gets resounding thumbs-up from FDA advisors.” Heartwire

3. Leon MB, et al. “Transcatheter aortic-valve implantation for aortic stenosis in patients who cannot undergo surgery”. New England Journal of Med.

4. Coyle, M. “Medtronic, Inc. Shareholder/Analyst Call”. www.SeekingAlpha.com. Accessed Sept. 9, 2011.

5. Mussallem, M. “Edwards Lifesciences’ CEO Discusses Q2 2011 Results – Earnings Call Transcript”. www.SeekingAlpha.com. Accessed Sept. 9, 2011.

December 24, 2025

December 24, 2025