News | December 26, 2013

AtriCure to Acquire Estech to Expand Ablation Portfolio

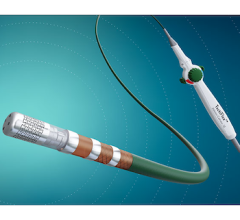

December 26, 2013 — AtriCure Inc., an atrial fibrillation (AF) medical device provider, and Endoscopic Technologies Inc. (Estech) announced that they have entered into a definitive merger agreement. AtriCure has agreed to acquire Estech for a cash-free, debt-free upfront payment of about 2.1 million shares, or $34 million of AtriCure common stock, and up to $26 million in additional consideration based on the achievement of certain revenue-based milestones. The transaction is subject to customary closing conditions and is expected to close in the next several weeks. AtriCure shareholder approval is not required.

Estech is a privately held company based in San Ramon, Calif. that developed a portfolio of surgical ablation devices that enable physicians to perform a variety of traditional and minimally invasive procedures usingproprietary temperature controlled radio-frequency (RF) energy.

“Estech is an ideal strategic fit for AtriCure, as it expands our presence and reinforces our commitment to the atrial fibrillation market,” said Mike Carrel, president and CEO, AtriCure. “The combination of the two companies enhances AtriCure’s leadership and intellectual property position across surgical ablation and epicardial left atrial appendage closure and accelerates the availability of broader surgical ablation offerings through the combination of Estech’s sales and marketing and R&D capabilities worldwide under the AtriCure umbrella.”

“Estech’s innovative surgical ablation portfolio is an excellent fit into AtriCure’s market leading portfolio,” said John Pavlidis, president and CEO, Estech. “Estech’s customers will be very well-served by AtriCure’s strong global sales and training presence and demonstrated long-term commitment to Atrial Fibrillation and LAA management.”

AtriCure expects that the transaction will increase sales and marketing expense as well as research and development expenditures in order to accelerate clinical development and commercial sales of the combined product portfolio. While these expenses will increase on absolute dollar basis, AtriCure expects these expenses to decrease as a percentage of sales beginning in 2015. AtriCure expects the transaction to be dilutive to earnings in 2014 and accretive in 2015 and beyond.

For more information: www.atricure.com, www.estech.com

January 22, 2026

January 22, 2026