October 14, 2014 — Although the highly saturated picture archiving and communication systems (PACS) segment is slowing growth in the U.S. imaging informatics market, a few niche areas are advancing forming new growth areas. The enterprise medical image viewers products are consolidating their place as a core component in the medical imaging informatics ecosystem. While these viewers presently address the needs of specific types of customers for specific use cases, their potential market reach is expanding rapidly.

New analysis from Frost & Sullivan's U.S. Enterprise Medical Image Viewers Market finds the market earned $44.8 million in revenue in 2013 and estimates this to reach $63.9 million in 2017. The adoption of new enterprise viewers will increase at both ends of the customer spectrum — ranging from large multi-site facilities looking for a full-fledged virtual reading environment to individual hospitals looking to better serve their referring physicians; however, demand will remain highest in the mid-size segments.

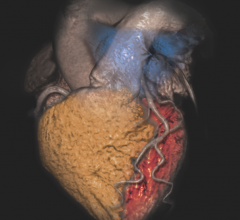

Currently, enterprise viewers are implemented as point solutions and used mostly as a tactical way to cater to the needs of secondary users of imaging, who historically would only have access to image reports. However, these viewers are gradually evolving to meet primary imaging users' diagnostic-grade requirements such as those in radiology, cardiology and orthopedics.

"U.S. enterprise viewer vendors must extend their product positioning beyond the niche, point-to-point function of clinical image review to address new, broader use cases," said Frost & Sullivan Advanced Medical Technologies Principal Analyst and imaging expert Nadim Michel Daher. "Primary study interpretation, imaging specialist collaboration, consolidated specialty image viewers and even patient access to images are some use cases still largely underserved in the market today."

The improved federated access to enterprise-wide images, combined with the diagnostic-grade image manipulation and interpretation functionalities being incorporated in the new-generation viewers, will likely boost the role of enterprise viewers in the imaging IT ecosystem. Though largely complementary solutions today, enterprise viewers, enterprise archives and stand-alone image exchange solutions may in fact become competing solutions that cannibalize each other's opportunity in the marketplace. Further, integration of viewers with electronic medical record (EMR) systems is one of the preferred ways to image-enable the EMR and can help fulfill on one of the only meaningful use (MU) menu items related to imaging.

Additionally, hybrid cloud solutions are becoming particularly attractive in the marketplace. They offer the benefits of the cloud model such as low startup costs, rapid software deployment and seamless upgrades while still maintaining critical and recent data onsite. Scalability, flexibility, and being able to operationalize costs, are other key attributes sought by prospective cloud customers.

"To attract more customers, enterprise viewer vendors must better articulate their value proposition regarding return on investment and total cost of ownership potential," advised Daher. "Doing so proactively helps their imaging clients build a strategy to make their services more visible to the healthcare enterprise. Customer segments paving the way for growth in the U.S. market include large integrated delivery networks, facilities with aging PACS, multi-PACS facilities, geographically disparate organizations, remote reading groups, teleradiology providers, and cloud-oriented facilities.

U.S. Enterprise Medical Image Viewers Market is part of the Advanced Medical Technologies Growth Partnership Service program. Frost & Sullivan's related studies include: U.S. Molecular Imaging Informatics Market, U.S. Nuclear Medicine and Positron Emission Tomography (PET) Imaging Systems Market, European Breast Imaging Systems Market, and European Ultrasound Market. All studies included in subscriptions provide detailed market opportunities and industry trends evaluated following extensive interviews with market participants.

For more information: www.frost.com

August 19, 2020

August 19, 2020