April 2, 2018 — GE Healthcare announced the sale of its Value-Based Care Division — including its software assets for Enterprise Financial Management, Ambulatory Care Management and Workforce Management — to private equity investment firm Veritas Capital. The sale, expected to be completed in third quarter 2018, was valued at $1.05 billion in cash.

The sale is part of an ongoing plan by General Electric CEO John Flannery — formerly president and CEO of GE Healthcare — to restructure the parent company and divest approximately $20 billion worth of assets. The global conglomerate has been struggling financially, with its stock dropping 56 percent in the past year, according to The Wall Street Journal. An October 2017 report in the Journal noted GE was actively seeking buyers for all or part of its healthcare business as one possible road to recovery.

“Veritas Capital is the ideal firm to provide the focus and investment to take our business to the next level of scale and performance. Our team has significant knowledge and expertise in the healthcare IT space, and by operating as a standalone business under Veritas’ ownership, we now have the opportunity to further revitalize our product portfolio and pursue complementary acquisitions to better serve patients, providers and payers,” said Jon Zimmerman, vice president and general manager of value-based care solutions at GE Healthcare. “With Veritas’ support and resources, we are excited to continue deepening our commitment and capabilities to help healthcare providers manage their financial, clinical and employee workflows across the continuum of care.”

Ramzi Musallam, CEO and managing partner of Veritas Capital, said, “We see a tremendous opportunity to invest in this business and partner with management to take advantage of a $9 billion market that continues to benefit from favorable sector trends, particularly a real and urgent need to digitalize our healthcare system. Similar to our previous healthcare technology investments, all of which have been corporate carve-outs, we will be deeply customer-focused, and invest significantly in people, technology and infrastructure to support the evolving requirements of the company’s diverse customer group. GE has built a highly regarded platform with a strong product set and an experienced team, and we look forward to supporting management as they redouble their focus on delivering superior value to all customers.”

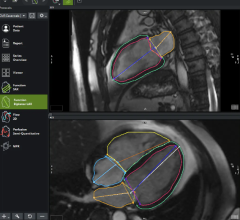

GE Healthcare President and CEO Kieran Murphy said the company will continue to invest in “core digital solutions,” including smart diagnostics, connected devices, artificial intelligence (AI) and enterprise imaging. He added that GE Healthcare will “continue to lead in data analytics, command centers, advanced visualization and image management tools to create better customer and patient outcomes.”

The healthcare technology space has been a key focus area for Veritas Capital, as illustrated by its recent investments in Truven Health Analytics and Verscend Technologies, both of which provide healthcare data and analytics services.

Veritas will work alongside the GE management team to ensure a seamless transition of the business into a standalone company.

Morgan Stanley and Keval Health are acting as financial advisors to GE in the transaction. Goldman, Sachs & Co. and William Blair & Company are acting as financial advisors and Schulte Roth & Zabel LLP is serving as legal counsel to Veritas Capital in the transaction.

The sale continues a trend of consolidation occurring among the major radiology vendors in recent months. Toshiba Medical was officially rebranded as Canon Medical Systems in January following acquisition by the Canon Group in December 2016.

For more information: www.gehealthcare.com

November 14, 2025

November 14, 2025