December 23, 2008 - St. Jude Medical Inc. said this week it completed the acquisition of Radi Medical Systems AB for $250 million in cash.

Radi is a leader in two segments of the market for cardiovascular medical devices in which St. Jude Medical does not currently participate - fractional flow reserve pressure measurement guide wires and manual compression-assist products for vascular closure. For 2008, Radi is expected to generate approximately $80 million in sales, a 19 percent increase over 2007.

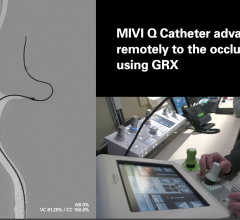

Radi’s pressure measurement guide wire, PressureWire Certus, comprises about a 70 percent share of the global market for physiological assessment of coronary lesions. The product is supported by a growing body of clinical evidence, including the FAME (Fractional Flow Reserve vs. Angiography for Multivessel Evaluation) study. The results of the FAME study were presented at the Transcatheter Cardiovascular Therapeutics conference in October 2008. The market for physiological assessment of coronary lesions totaled more than $60 million in 2008 and is projected to continue growing at a strong double-digit rate, St. Jude said

Radi’s FemoStop and RadiStop product lines comprise about a 60 percent share of the global market for manual compression-assist products for vascular closure. This market totaled about $45 million in 2008 and is projected to continue to grow at least at a mid single-digit rate. The FemoStop and RadiStop product lines, together with St. Jude Medical’s Angio-Seal line of active vascular closure products, will be part of an expanded program by St. Jude to develop the potential of a global vascular closure device market that is only about 27 percent penetrated, the company said.

With this transaction, Radi Medical Systems will become part of the St. Jude Medical Cardiovascular Division. The transaction is expected to be neutral to St. Jude Medical’s consolidated earnings per share in 2009 and is expected to be positive to consolidated earnings per share beginning in 2010. St. Jude Medical funded the acquisition with cash on hand outside the U.S. as well as with the proceeds from a new three-year term loan established recently with a syndicate of banks.

For more information: www.sjm.com, www.radi.se, www.famestudy.com

February 12, 2026

February 12, 2026