Continuous advances in critical patient care have enabled to develop efficient hemodynamic monitoring systems featuring non-invasive technology and expanded parameters such as continuous BP measurements, measurement of cardiac output by pulse contour method, among others. Major market players are continuously focusing on investing in research activities for new product developments and expanding their geographic reach to strengthen their position in the hemodynamic monitoring market. Some of the technological advancements are listed below:

- In July 2022, Retia Medical received Series B funding of $15 million led by Fresenius Medical Care Ventures to expand its commercial team and accelerate the development and commercialization of its Argos Hemodynamic Monitor.

- In February 2022, Caretaker Medical received the US Food and Drug Administration (FDA) clearance to add four new parameters on its next-generation VitalStream wireless ‘beat-by-beat’ blood pressure and hemodynamic monitoring platform, to include stroke volume, cardiac output, left ventricular ejection time, and heart rate variability.

- In March 2021, Philips introduced its interventional hemodynamic system featuring a patient monitor- IntelliVue X3 to provide advanced hemodynamic (blood flow) measurements and improve patient focus during image-guided procedures.

- In October 2020, Getinge launched NICCI, an innovative advanced hemodynamic monitoring solution that provides continuous and non-invasive hemodynamic insights reducing the risk of severe complications in patients with low blood pressure.

Growing Prevalence of Cardiovascular Diseases to Boost Adoption of Hemodynamic Monitoring Market

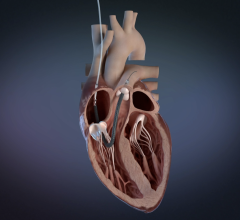

Advanced hemodynamic monitoring methods have the ability to enhance the monitoring of cardiac patients during post-operative care and anesthesia providing precise and repeatable measurements to detect hemodynamic abnormalities and their causes. Cardiovascular diseases are one of the leading causes of death across the world. Coronary heart disease, cerebrovascular disease, rheumatic heart disease, and other illnesses are among the group of heart and blood vessel disorders known as CVDs.

According to WHO, 32% of all deaths across the globe i.e., 17.9 million people die due to CVD every year.

As per CDC,

- 659,000 people in the US die from heart disease every year; heart diseases costs $363 billion each year in the US which includes cost of medicines and healthcare services.

- Coronary heart disease alone killed 360,900 people in 2019 in the US and over 18.2 million adults suffering from coronary artery disease live in USA.

- 805,000 people suffer from heart attack in the US every year of which 605,000 are a first heart attack while 200,000 happen to people already had a heart attack.

- According to European Heart Network, CVDs account for over 3.9 million deaths every year in the https://www.ehnheart.org/European region, out of which over 1.8 million deaths occur in the European Union (EU).

Furthermore, rising geriatric population prone to heart defects due to progressive deterioration in the structure and function of the heart, largely contributes to the high burden of CVDs; thereby triggering the increased adoption of hemodynamic monitoring systems.

Issues related to Hemodynamic Monitoring Systems – A Deterrent for Hemodynamic Monitoring Market Growth

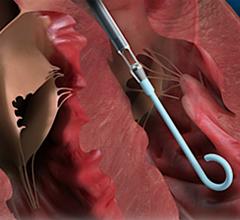

Although hemodynamic monitoring offer multiple advantages to patients and caregivers, there are certain issues related to the use of this patient monitoring technology. Dysrhythmias, catheter knotting, balloon rupture, pulmonary artery rupture, infection, pulmonary infarction, and deep vein thrombosis are a some of the potential complications associated with hemodynamic monitoring.

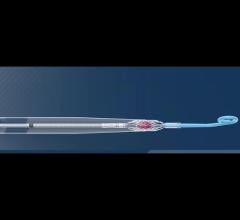

Invasive monitoring pose significant risks, hence using this technique is only advised for a select group of conditions in which the risks associated are overshadowed by the advantages of the information they provide during a particular procedure. Furthermore, invasive hemodynamic monitoring is expensive and requires trained professionals to insert catheters in patients. In addition, it is not advised for old and weak patients to employ invasive hemodynamic monitoring system. Although, invasive hemodynamic monitoring offers precise and comprehensive information on patients’ hemodynamic state, their usage is constrained by the risks associated with it.

Interpretation of hemodynamic values and waveforms plays a vital role in accurate diagnosis and effective monitoring of critically ill patients. Misinterpretation of this data is one of the major complications associated with the use of hemodynamic monitoring systems. Due to the criticality in technical aspects such as acquiring and interpreting pulmonary artery catheterization (PAC) pressure waveforms, there is a need for appropriate training and experience. Shortage of trained professionals in developing countries limits the adoption of hemodynamic monitoring systems.

Irrespective of these issues and challenges, hemodynamic monitoring market is expected to grow at a steady rate due to rapid advancements in new technologies such as minimally invasive and non-invasive hemodynamic monitoring systems. Substantial improvements in terms of computer processing, biosensors, and miniaturization, coupled with improved understanding of critical cases at molecular level are expected to further drive the hemodynamic monitoring market growth.

Competitive Landscape Analysis: Hemodynamic Monitoring Market

The global hemodynamic monitoring market is marked by the presence of key market players such as Edwards Lifesciences Corporation (US); Getinge AB (Sweden); LiDCO Group (UK); Koninklijke Philips N.V. (Netherlands); ICU Medical (US); and others.

October 23, 2023

October 23, 2023