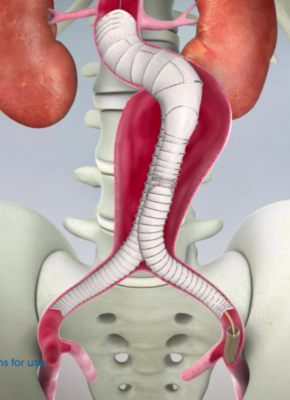

September 5, 2016 — Lombard Medical Inc., a company focused on endovascular aneurysm repair (EVAR) of abdominal aortic aneurysms (AAAs), reported Aug. 22 is was closing its U.S. operations to focus on more profitable markets overseas. This was a key component of the company’s significant operational restructuring and the exploration of strategic alternatives do to poor financial reports.

Second quarter 2016 global revenue was $3.8 million, representing a 30.1 percent sequential increase from $2.9 million in the 2016 first quarter. Revenue from both the Altura and Aorfix endovascular stent grafts in Lombard’s European direct sales markets in the United Kingdom, Germany and the Netherlands grew 20.9 percent sequentially and 42.6 percent year-over-year.

Due to that overseas growth, Lombard announced it is allocating its resources to exclusively support the new Altura AAA stent graft system and the recently CE-marked IntelliFlex LP delivery system for Aorfix in the European Union, Japan and other key international markets. The Aorfix sales force in the United States has been eliminated and the majority of commercial operations have transitioned to the company’s facility in the U.K. As a result of the restructuring, the cash requirements associated with operations have been significantly reduced, the company said.

“Our shift in geographical commercial focus is starting to deliver strong sales growth in the Western Europe direct markets as Altura gains traction,” said CEO Simon Hubbert. “We expect to see this growth accelerate as we expand Altura into new centers. We are very encouraged by the physician feedback and excellent clinical results we are seeing from Altura and believe that with the introduction of the new IntelliFlex delivery system for Aorfix, we now have a world-class product portfolio providing a full range of solutions for the treatment of AAA.

“In the U.S., the FDA is requiring additional clinical data to support the application for U.S. approval of the IntelliFlex delivery system. This pushes the potential approval timeline out significantly,” added Hubbert. “We have, therefore, decided to discontinue funding commercial operations in the U.S. at this time and instead solely focus our resources on growing revenue in Europe, Japan, and other key international markets where we are able to benefit from the enhanced Aorfix delivery system as well as the direct and synergistic effect of Altura.”

In addition, in order to enhance shareholder value, the company’s board of directors has engaged Cain Brothers as its investment banker to begin a process of exploring strategic alternatives, including a potential sale of the company or disposition of certain assets, as well as distribution or other strategic partnerships. Separately, the company will also be evaluating additional financing opportunities during this time.

Financial Shortfalls

For the 2016 second quarter global revenue was $3.8 million as compared to $4.5 million in the same prior year period, the company reported. For the first six months of 2016, global revenue was $6.7 million as compared to $7.9 million in the prior year period. Lombard said the year-over-year reduction in revenue is attributable to the redeployment of commercial resources from the U.S. to Europe to support the launch of Altura coupled with delayed stocking orders from the company’s distribution partner in Japan as it prepares for approval and launch of the IntelliFlex delivery system.

Gross margin for the 2016 second quarter and first six months was 10.9 percent and 20.8 percent, respectively, compared to 51.7 percent and 49.4 percent for the prior year periods. Second quarter margins were adversely impacted by several factors including the manufacturing start-up expense related to the launch of the Altura product line into Europe and other locations outside the U.S. Additionally, reduced overhead absorption on lower volume coupled with the company’s transition of manufacturing activities to the new generation IntelliFlex delivery system contributed to the margin variance.

Operating expenses for the 2016 second quarter and first six months were reduced to $7.7 million and $16 million, respectively, compared to $10.6 million and $21.9 million in the prior year periods. The significant decrease in operating expense was accomplished by the reduction in the U.S. sales force, trimming non-essential programs and general cost control activities in all areas of the business, the company said.

The net loss for this year’s second quarter was $8.3 million, or $0.42 loss per share, compared to a net loss of $8.2 million, or $0.51 loss per share, for the second quarter of 2015. For the first six months of 2016, the net loss was $15.9 million, or $0.80 loss per share, compared to $17.7 million, or $1.10 loss per share, for the prior year period.

Lombard’s Operational Highlights

In Japan, Aorfix procedure rates continued to rise as physicians performed 135 Aorfix procedures in the 2016 second quarter as compared to 95 in the prior year period. These procedures represent an approximate 7.5 percent share of the total Japanese AAA market. The continued share gain did not translate directly to revenue growth in the period as Lombard’s Japanese distribution partner continued to sell through inventory in anticipation of the launch of the new Aorfix IntelliFlex delivery system.

CE mark approval was received in June for the Aorfix IntelliFlex delivery system with the first commercial use following shortly thereafter in Orense, Spain.

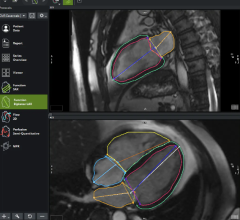

Positive 30-day clinical results were reported in May on 57 patients who were implanted with Altura. The Altura Altitude Global Registry will be conducted in Europe to evaluate the use of Altura in real world procedures with a planned enrollment of 1,000 patients starting in late 2016.

For more information: www.lombardmedical.com

November 14, 2025

November 14, 2025