October 18, 2007 - Boston Scientific Corp. today announced it will restructure or sell several business units to reduce operating expenses by 13 percent in 2008 in a move designed to enhance short- and long-term shareholder value.

The company also said it is making good progress toward the execution of its previously announced plans to sell non-strategic assets and monetize the majority of its public and private investment portfolio. The Company said these initiatives will help provide better focus on core businesses and priorities, which will strengthen Boston Scientific for the future and lead to increased, sustainable and profitable sales growth.

The company plans to reduce its operating expenses (exclusive of amortization and royalty expenses) against a 2007 baseline of approximately $4.1 billion by an estimated $475 million to $525 million in 2008, representing a reduction of 12 to 13 percent, with a further reduction of an estimated $25 million to $50 million in 2009.

The company plans to eliminate approximately 2,300 positions worldwide, or approximately 13 percent of an 18,000-person, non-direct labor workforce baseline as of June 30, 2007. Eligible employees affected by the head count reductions will be offered severance packages, outplacement services and other appropriate assistance and support. The reduction activities will be initiated this month and are expected to be substantially completed worldwide by the end of 2008. Reductions outside the United States will be initiated following completion of information sharing and consultations with required bodies. In addition, another approximately 2,000 employees are expected to leave the Company in connection with the previously announced business divestitures.

The reductions will result in total pre-tax charges of approximately $450 million to $475 million, or $0.20 to $0.22 per diluted share. These mostly cash charges will be recorded primarily as restructuring expenses, with a portion recorded through other lines of the income statement. Approximately $275 million to $300 million will be recorded in the fourth quarter of 2007 with the remainder expected to be recorded throughout 2008 and 2009.

The company plans to restructure several businesses and product franchises in order to leverage resources, strengthen competitive positions, and create a more simplified and efficient business model. Key components of the business restructuring plan include:

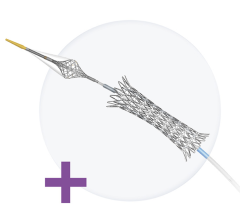

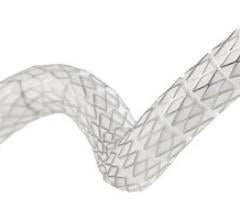

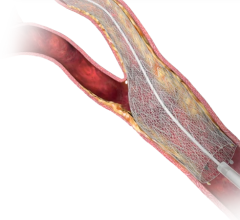

-- The peripheral interventions and interventional cardiology businesses will be combined under a single management structure to help create a more integrated business focused on interventional specialists, while enhancing technology and management efficiencies.

-- The electrophysiology business will be integrated with the cardiac rhythm management business to better serve the needs of electrophysiologists by creating a more efficient organization.

-- The oncology business and its four franchises will be restructured. Three will be integrated into other businesses within Boston Scientific, and the Oncology Venous Access franchise will be combined with the Fluid Management business.

-- The company is actively seeking buyers for the combined fluid management/oncology venous access business, as well as its cardiac surgery and vascular surgery businesses. The company has announced it has entered into a definitive agreement to sell its Auditory business. Collectively, these businesses represent approximately $550 million in 2007 sales for Boston Scientific.

-- The International group will be consolidated from three regions to two. The existing three regions are: Europe, Asia Pacific/Japan, and Inter-Continental; the two new regions will be: Europe/Middle East/Africa, and Canada/Latin America/Asia Pacific/Japan.

For more information: www.bostonscientific.com.

November 24, 2025

November 24, 2025