Getty Images

January 3, 2023 — The market has been studied for the below mentioned-segmentation and regional analysis for North America, Europe, Asia, South America, and Middle East and Africa. These are the key regions where the Cardiac pacing leads market is operating currently and is predicted to expand in the near future. The manufacturers and suppliers involved in the cardiac pacing leads market are present across various countries in the above-mentioned regions.

The report provides a detailed understanding of the market segments formed by combining different prospects such as the product type, technology, end user and region. The key driving factors, restraints, potential growth opportunities and market challenges are also discussed in the paragraphs below.

The significant players operating in the global cardiac pacing leads market are Zoll Medical Corporation, MicroPort Scientific Corporation, OSCOR Inc., Osypka Medical GmbH, Medtronic, Abbott, Boston Scientific Corporation, BIOTRONIK, LivaNova, among others. To achieve a substantial market share in the worldwide cardiac pacing leads the market and strengthen their position, manufacturers are pursuing expansion methods such as current developments, mergers and acquisitions, product innovations, collaborations, and partnerships, joint ventures.

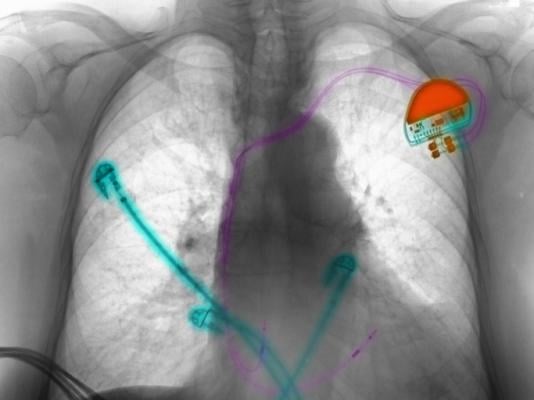

A heart-pacing lead is a small catheter with electrodes. It is introduced into the heart's right ventricle through a vein in the neck or groyne. The cardiac cells depolarize as a result of the electrical impulses that leads send to the heart. Leads have two pieces, such as electrode wire and conductive leads. According to estimates from the World Health Organization (WHO), 17.5 million people worldwide died in 2016 as a result of cardiovascular diseases. Cardiac arrests, ventricle dysfunction, and a slow pace of ventricle depolarization mostly bring on cardiovascular diseases. The pacing link is used to deliver electrical simulated impulses from the pacemaker to the heart. The pacing leads are essential to the pacemaker device's effectiveness. It is used in cardiovascular treatment. Doctors can benefit from the electrical circuitry of the heart's mapping. They are minimally invasive devices positioned on the myocardium after heart surgery. These devices are connected to the pacemaker in order to monitor the electrical activity of the heart. Pacing leads may be placed in the right atrium, the ventricle, or perhaps both. Using this device in either the atrium or the ventricle is referred to as single-chamber pacing, whilst using it in both the atrium and the ventricle is referred to as dual-chamber pacing. Unipolar and bipolar pacing leads are the two types of pacing leads available. They are used in hospitals, outpatient surgery centers, and clinics.

Segmentation Analysis

The bipolar segment is expected to be the fastest-growing segment in 2021.

The product type segment is Unipolar, Bipolar, and Others. The bipolar segment is expected to witness the highest growth rate during the forecast period. Unipolar leads were initially more common because of lead diameter. The dimensions of modern pulse generators and bipolar leads are similar. For unipolar pacing, sensing is a challenge, particularly in the atrium. Bipolar pulse generators can now be set to do unipolar pacing or sensing. Bipolar pacing leads are now implanted in each patient as a result.

Epicardial Pacing is expected to be the fastest-growing segment in 2021.

The technology segment includes Transcutaneous Pacing, Transvenous Pacing, and Epicardial Pacing. The Epicardial Pacing segment is expected to witness the highest growth rate during the forecast period. Due to their small size, intricate anatomy, electrophysiologic anomalies, and challenging access to the cardiac chambers, children and patients with congenital heart disease who require permanent cardiac pacing face challenges. Epicardial pacing is still the go-to therapy for infants and people with complex congenital heart disease.

Catheterization Labs is expected to be the fastest-growing segment in 2021.

The end user segment includes Catheterization Labs, Orthopedic Clinics, Hospitals, and Ambulatory Surgery Centers. The Catheterization Labs segment is expected to witness the highest growth rate during the forecast period. You can discover more about your congenital heart problem through a cardiac catheterization, a minimally invasive test. A congenital heart defect is a heart malformation that has existed since birth. The structure and operation of the heart are affected by the abnormality.

Regional Analysis

The regional analysis provides a detailed perception of the key regions and the countries. Some of the key countries analyzed for the cardiac pacing leads include the US, Canada, Mexico, Germany, France, the U.K., Italy, Spain, Russia, China, Japan, India, Brazil, Peru, UAE, South Africa, and Saudi Arabia.

The North America region witnessed a major share. North America now holds a dominant position in the global market for cardiac pacing leads as a result of the acceptance of new technology and its advancement. According to UN estimates, there will be 962 million individuals in the globe who are 60 years of age or older and 2.1 billion by 2050 and 2100, respectively. North America is predicted to have significant growth in the global market for cardiac pacing leads over the next several years due to increased lifestyle-related illnesses, technological advancements, and higher spending in healthcare infrastructure. The key players in the market for cardiac pacing leads are focusing on creating cutting-edge, efficient cardiac lead devices and introducing them in developing markets in order to meet consumer demand for various types of cardiac pacing leads. For instance, on April 9, 2019, Oscor, Inc. and Micro Interventional Devices Inc. forged a strategic partnership to advance the business' ability to create and sell cutting-edge devices for heart disease.

Country Analysis

Germany. Germany's cardiac pacing leads market size was valued at USD 3.66 billion in 2021 and is expected to reach USD 5.83 billion by 2029, at a CAGR of 6% from 2022 to 2029. The need for cardiac pacing in Germany is being driven by an increase in the desire to cut healthcare costs as well as shifting dynamics in hospital and healthcare settings. The adoption of high-quality, affordable care is predicted to have an effect on the market's expansion. The importance of this component is rising.

China: China’s cardiac pacing leads market size was valued at USD 3.85 billion in 2021 and is expected to reach USD 6.6 billion by 2029, at a CAGR of 7% from 2022 to 2029. The need for inexpensive medications, mounting pressure to reduce healthcare costs, and hitherto unheard-of medical situations like COVID-19.

India: India's cardiac pacing leads market size was valued at USD 3.74 billion in 2021 and is expected to reach USD 6.3 billion by 2029, at a CAGR of 6.8% from 2022 to 2029. Due to the rapidly growing medical tourism business, the unmet medical requirements of the population, growing levels of awareness, and the increasing spending power of the locals.

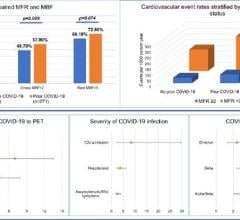

COVID-19 Impact

Covid-19 had a major impact on almost all industries, such as electronics, semiconductors, manufacturing, automobile, etc. However, several companies operating in the technology sector have seen increased revenue due to significant changes in consumer preferences toward technological services. In addition, the pandemic has led to significant growth in technology across developing and developed countries.

Furthermore, the growth of this market is mainly driven by the aging population, the rising prevalence of cardiovascular diseases, and technological advancements.

For more information: https://greyviews.com/checkout/229/single_user_license

March 20, 2024

March 20, 2024