October 5, 2010 – After a period of capital budget cuts and freezes, hospitals are seeing a thaw in capital expenditures, according to a survey published in the Premier healthcare alliance’s September 2010 Economic Outlook analysis.

Sixty-nine percent of healthcare representatives responding to the survey indicated that capital budgets for 2010 remained flat or increased compared to 2009. Overall, 42 percent of respondents suggested an increase in spending versus 32 percent suggesting a decrease. For those whose budgets decreased or remained unchanged from last year, approximately 66 percent scaled back projects already in progress specific to new construction/renovations and the acquisition of clinical and information technology.

When asked about the top areas in which they are trying to reduce costs in the next 12 months, commodity pricing (27 percent), physician preference utilization (25 percent) and pharmaceutical utilization (19 percent) were cited most often.

The semiannual Economic Outlook analysis helps Premier’s 2,400 not-for-profit hospital members better estimate supply cost inflation during their budget processes, projecting rates of inflation for the ensuing 12 months.

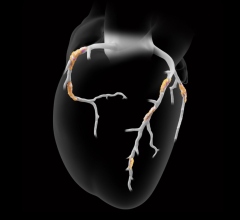

According to the September 2010 edition, annual market inflation rates will increase on average between 1 percent and 3.7 percent across categories such as cardiovascular services, facilities, imaging and nursing. Premier's existing contracts, excluding foodservice and pharmacy, are expected to increase by about 1 percent on average in the next year, lower than overall market increases, which are predicted to be an average of 2.6 percent during this time frame.

“Accounting for 25-30 percent of a hospital’s expense, the supply chain presents a vital opportunity to help offset reimbursement cuts and has increasingly become an area of focus for the C-suite,” said Premier Purchasing Partners President Mike Alkire. “But the approach to supply chain improvement needs to extend well beyond price points; it should identify opportunities to change practice and purchasing patterns to simultaneously improve outcomes and reduce costs. This can be achieved through resource utilization, standardization and aggregation strategies.”

Not surprisingly, survey respondents suggest reform is top-of-mind, with more than 80 percent considering “healthcare reform and changes in reimbursement” and “electronic health record (EHR) implementation and data storage” as the most important health trends today. And 73 percent anticipate these two areas will have the greatest impact on their financial performance over the next year.

“To ‘make it’ under Medicare in a reform environment, hospitals need to identify key areas offering cost savings and revenue enhancement opportunities to offset reimbursement cuts,” said Wes Champion, senior vice president of Premier Consulting Solutions.

According to Champion, these areas include:

• Clinical care delivery through reductions in variability, mortality and hospital-acquired conditions in preparation for value-based purchasing;

• Work flow and work force efficiency specific to enhancing work force management and patient throughput;

• Resource optimization, including proper resource standardization and utilization in areas such as ancillary utilization, length of stay and physician preference;

• Supply chain and non-labor strategies such as whether to outsource purchased services, sourcing, procurement and payment, and inventory and distribution;

• Revenue enhancement through improvements in revenue cycle and reimbursement (Medicare/Medicaid cost reporting, managed care contracting, coding); and

• Strategies aligning incentives for physicians to assist with cost savings, compensation development and strategies, and utilization benchmarking.

Premier produces a new analysis every six months to ensure projections reflect changing market trends. The analysis helps alert Premier alliance hospital members to market forces that could drive price changes in the coming months and years. It compares Premier’s contractual price protection against supplier price inflation estimates to deliver forecasted estimates by service line.

Premier polled approximately 500 of its contracted suppliers to obtain market inflation estimates. Additional inflation estimates by category include clinical laboratory services, foodservice, IT/telecommunications, pharmacy, support services, surgical services and women and children's.

For more information: www.premierinc.com/costs/tools-services/Economic%20Outlook /PUR1759BK_Economic%20Outlook%20October%202010.PUBLIC.pdf

February 02, 2026

February 02, 2026