An example of a patch type cardiac monitor from Vital Connect. These types of inexpensive, stick-on wearable monitors have seen a tremendous increase in use over the past few years, replacing traditional Holter monitors.

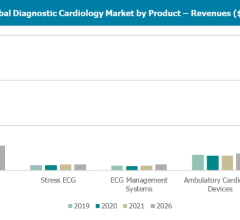

May 6, 2021 — The wearable cardiac devices market is set to grow from its current market was valued at more than $1.2 billion in 2019 to $6.2 billion by 2026, according to a new research report by Global Market Insights.

The increasing adoption of wearable technology across the healthcare sector is likely to drive the global wearable cardiac devices market share. In addition to the rising adoption, the rising demand for the use of non-invasive devices is also expected to push product adoption over the coming years. The latest wearable devices, which come as skin patches, are non-invasive, lightweight, and small. Owing to these characteristics, the patients do not have to endure implantation procedures to obtain the capability to record their cardiac parameters continuously.

Recently available wearable devices consist of noteworthy features such as non-invasiveness, small size, and light weight. Non-invasive device adoption has been accelerating at a rapid pace globally, which in turn, is likely to add impetus to industry growth in coming years.

Furthermore, accelerating incidence of patients suffering from cardiovascular disorders, including cardiac rhythm disorders, alongside rising disease prevalence among elderly adults will amplify wearable cardiac devices market expansion. According to CDC estimates, over 2-6 million Americans are suffering from atrial fibrillation, which poses high potential risks as the age increases.

Implementation of wearable cardiac devices over bulky and traditional monitoring devices is slated to proliferate at a rapid pace owing to the needs to continuously monitor patients’ heat rate, ECG and other indicators to avoid treatment delays for conditions such as arrythmias, thereby leading to vast product prominence.

However, stringent government regulations on device adoption and issues with patient privacy and data security are likely to hinder the wearable cardiac devices market dynamics over the projected timeframe.

With regards to the product spectrum, the global wearable cardiac devices industry is categorized into Holter monitors, defibrillators, patch, and others. Of these, the defibrillators segment is set to register a CAGR of more than 22% through 2026.

For instance, Zoll LifeVest Wearable Defibrillator is a device used for remotely monitoring the rhythm of heartbeats of patients who are prone to heart attacks, and can also deliver shock in the event that the patient is unresponsive even after several warnings, which provides opportunities for the segment to grow exponentially.

In terms of segmentation by application, the home healthcare segment held nearly 25% of the overall wearable cardiac devices market share in 2019. The prevalence of this segment can be attributed to easy handling, high convenience, and effective patient monitoring while at home.

Additionally, factors such as rising disposable income and preference for home treatments further aid in elevating home healthcare to a dominant position in the wearable cardiac devices business landscape.

On the regional front, the North American wearable cardiac market accounted for a market share of more than 60% in 2019 and is anticipated to witness a major upsurge over the forecast spell.

Digital transformation in the healthcare landscape, along with rapid innovative device launch by new entrants in the United States has contributed to the growing product adoption. Moreover, increased awareness of wearable technology in the region will further influence market expansion in years ahead.

Key wearable cardiac devices market participants include Welch Allyn, Philips, BioTelemetry, iRhythm Technologies, and Zoll Medical, among others. These players are focused on various growth strategies such as M&A, product launch, and innovations. For example, BioTelemetry Inc. entered an acquisition deal with Geneva Healthcare to strengthen the cardiac monitoring portfolio of BioTelemetry.

For more information: www.gminsights.com/pressrelease/wearable-cardiac-devices-market

November 12, 2025

November 12, 2025