Getty Images

The global cardiovascular diagnostic and monitoring devices market was valued at $14.2B in 2021 and is projected to record a CAGR of 7.5% from 2022 to 2031.

Continuous advancements in technologies for remote monitoring systems for cardiac signals, such as IoT technologies, is broadening the market outlook. Rapid incorporation of machine learning algorithms in cardiovascular diagnostic and monitoring devices is likely to augment the market share.

Adoption of artificial intelligence (AI) in these devices has the potential of early identification of arrhythmias. Surge in development of cardiovascular disease (CVD) prediction systems is leading to significant the market development. For instance, IoT system for self-diagnosis of heart diseases is generating significant attention among healthcare professionals and patients. Another instance is growing usage of mobile cardiac telemetry in outpatient settings in developing countries.

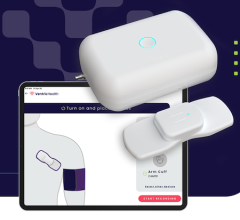

Surge in demand for portable devices for monitoring and diagnosis of intermittent arrhythmias presents lucrative business opportunities for medtech companies to tap into the market in the next few years. An analysis of market trends indicates popularity of wearable devices, such as wearable continuous ECG monitoring patches for the management of CVD is rapidly growing.

Key Findings of Study

- Steady Technological Advancements in ECG Monitors: Based on product type, the ECG devices segment is projected to record rapid growth from 2023 to 2031. Considerable adoption of non-invasive and painless processes for the CVD monitoring and diagnosis of heart diseases and intermittent arrhythmias is propelling the segment. Rapid increase in utilization of wireless cardiac monitoring devices is expected to boost the market.

- Significant Demand for Subcutaneous Cardiac Rhythm Monitors: Introduction of implantable cardiac monitors (ICMs)/implantable loop recorders that can accurately monitor the patient remotely is anticipated to offer lucrative opportunities to companies in the market. Utilization of ICMs to detect the risk arrhythmias, recurrent syncope, and cryptogenic stroke in the target population has surges significantly. Need for advanced atrial fibrillation (AF) detection methods is projected to drive the adoption of ICMs in the hospital settings in the near future. Recent trends indicate considerable improvements in accuracy of ICM in the diagnosis of underlying arrhythmias in patient populations globally. Significant usage of ICMs in ambulatory (continuous) ECG (AECG) monitoring is anticipated to augment the implantable loop recorders product segment.

Key Drivers

- Pressing need for early diagnosis of CVD is a significant driver of the cardiovascular diagnostic and monitoring devices market. Technological advancements in these devices help in reducing the AF burden and in effective treatment of arrhythmias in patients. Rise in the elderly population is enhancing prevalence of AF. Thus, rapidly aging population is anticipated to drive the evolution of the market.

- Rise in need for long-term, non-invasive ECG monitoring is expected to drive the development of the cardiovascular diagnostic and monitoring devices market

Regional Growth Dynamics

North America constituted a major share of 40% of the global cardiovascular diagnostic and monitoring devices industry in 2021. Rise in prevalence of heart failure and rapid pace of adoption of novel devices to diagnose and monitor arrhythmias among patients in the U.S. are likely to bolster the market size in North America. High rate of hospitalization in AF is propelling the demand for CVD monitoring devices to diagnose/screen asymptomatic patient population. Early adoption of remote cardiovascular monitoring technologies in the region presents significant business opportunities to companies in the market.

The Asia Pacific market is anticipated to record rapid growth due to rise in demand for advanced technology for early diagnosis of arrhythmias and treatment of patients with heart failure.

Competition Landscape

The market landscape is highly competitive, with leading players focusing on product line expansion, merger & acquisition, and strategic alliances to consolidate their market positions in the near future.

Prominent companies operating in the market are

• Boston Scientific Corporation

For more information: https://www.transparencymarketresearch.com/checkout.php?rep_id=2385<ype=S

February 03, 2026

February 03, 2026