Getty Images

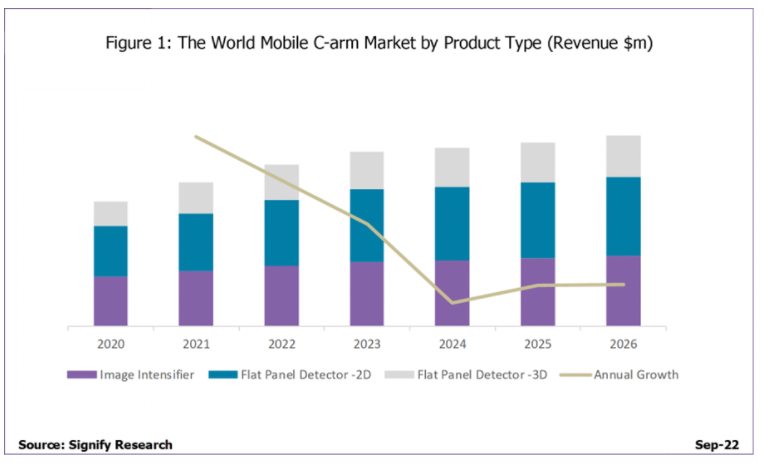

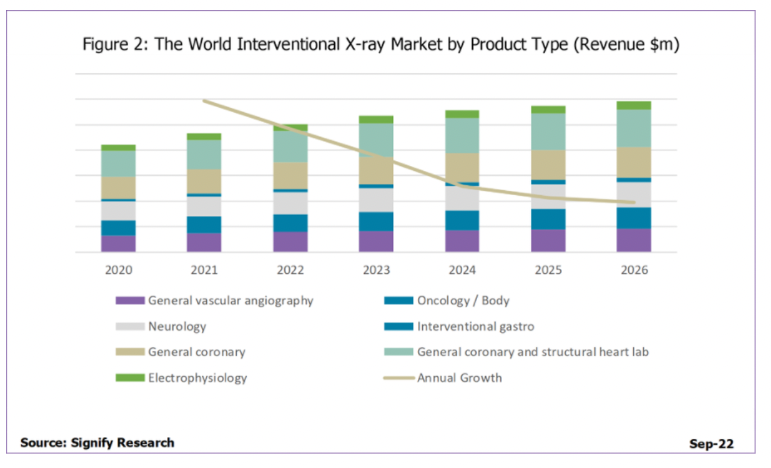

The world market for interventional X-ray and mobile C-arm equipment is forecast to reach over $4.9 billion by 2026, according to a new report from Signify Research. The world markets for Interventional X-ray systems and mobile C-arms increased by 10.2% and 15.5% respectively in 2021. The markets recovered strongly as the negative impact of the coronavirus pandemic subsided, and delayed orders were fulfilled.

Product Trends

In the mobile C-arm market, flat panel detector (FPD) 2-D mobile C-arms are forecast to have the fastest growth through to 2026, with a revenue CAGR of 6.5%. Demand for image intensifier systems is being maintained by emerging regions or low risk applications such as pain management in developed countries. The United States, China, Japan and Western Europe will continue to lead adoption of 3-D C-arm technology. However, the penetration of 3-D mobile C-arms must overcome barriers in the US market, such as strong preferences for hybrid operating rooms (HORs) and Medtronic’s O-arm for spinal surgery due to favorable reimbursement.

Within the Interventional X-ray market, strong growth is projected for the structural heart market, with left atrial appendage closure procedures and mitral valve interventions maintaining clinical demand. Interventional neurology is a key growth area within interventional radiology. The increasing number of stroke centers globally, as well as adoption of bi-plane systems for multi-disciplinary use, for instance for vascular procedures, is driving demand for interventional neurology systems. The primary applications for HORs include cardiac and vascular procedures, followed by spinal procedures.

Regional Trends

Americas:

- As clinical cases become more complex and interventional X-ray technology becomes more advanced, it is becoming increasingly difficult for interventionalists to gain expertise across all available software and applications.

- An increase in the complexity of interventional procedures maintains demand for high-end solutions, where the required generator power is regulated to ensure patient safety. Most new demand for mobile C-arm technology will be accounted for by outpatient clinics and facilities in the United States.

- Most countries in Latin America have budget constraints and are price-sensitive, so tend to purchase low-end to mid-range systems rather than higher-end systems. In Brazil, there has been a transition from image intensifier technology towards mid-range and low-end mobile 2-D FPD C-arms with basic functionality to support simple surgery. The Rest of Latin America has both emerging and developed markets, with pockets of strong growth coming from Columbia, Argentina and Chile.

EMEA:

- Western European governments are expected to focus on healthcare reforms, cost-containment, and increasing return-on-investment throughout the forecast period. Demand for interventional X-ray systems in therefore dependent on the expansion of existing healthcare facilities, such as larger, new hospitals to replace older hospitals and new cardiac centers.

- The Western European market has a strong preference for floor mounted systems. There is a greater uptake of 2-D and 3-D FPD systems compared to Eastern Europe, with the German market having the highest uptake of 3-D C-arms in 2021.

- Higher-specification, higher-cost equipment is typically purchased in Northern Africa and South Africa, while central Africa is predominantly a very low-end interventional X-ray market.

- In Eastern Europe, Poland is forecast to be a growth market as the European structural and investment funds will support healthcare investment over the coming years.

Asia Pacific:

- China is the second largest market for interventional X-ray systems, after the United States. A key growth driver is the rapidly increasing number of tier 1 hospitals.

- India has one of the best practices for cardiovascular medicine globally, ranking the third highest country for the number of TAVI procedures performed. From a clinical standpoint, the increasing number of stent procedures is facilitating additional growth for cath labs and better utilization of existing cath labs.

- Demand for image intensifier mobile C-arms is falling in China, with 2-D FPD mobile C-arms accounting for most of the market. Strong price erosion due to increased competition amongst local mobile C-arm vendors in China is hindering revenue growth. Low-cost mobile C-arm systems in India tend to fall into the super-value market segment, which accounts for more than 70% of the total mobile C-arm market in India.

Future Outlook

In the coming years, market growth for both interventional and surgical X-ray equipment is forecast to be positive following a year of market retraction in 2020. Beyond the pandemic, the main growth drivers will continue to be the growing burden of chronic diseases owing to changing lifestyles and the rising need for cost effective, minimally invasive interventional procedures. The rising prevalence of chronic conditions, such as cancer, heart disease, and others, and advances in minimally invasive, targeted treatments using imaging guidance continue to drive the market. Increasing competition from Asian manufacturers is increasing the affordability and adoption of image guided therapy systems in emerging countries. The increased demand for complex neurology, oncology and cardiovascular procedures means that hospitals are increasingly prioritizing advanced multidisciplinary equipment. Advanced features such as AI, dose management and treatment planning capabilities will increase the uptake of more high-end technology in developed countries. Within the mobile C-arm market, positive growth from 2021 onwards is attributed to the rising geriatric population with a high susceptibility to chronic conditions such as cardiovascular, orthopedic and respiratory diseases. This, alongside increasing patient awareness of the benefits of minimally invasive procedures, is expected to drive the market growth over the forecast period.

Bhvita Jani is a senior market analyst at Signfy Research. She is part of the medical imaging team focusing on the X-ray market. She brings with her 3 years' experience covering X-ray, MRI and CT research at IHS Markit. She previously worked as an assistant clinical psychologist. She received her bachelor's degree in biology and psychology from Aston University. Signify is a healthcare market research firm based in the U.K. For more information: www.signifyresearch.net

Related Interventional Angiography System Content:

Angiography Systems Comparison Chart

7 Trends in Interventional Lab Angiography Systems

360 View of a Cath/EP Combo Lab at Baylor Heart Hospital Dallas

Dose-Lowering Practices for Cath Lab Angiography

Canon Medical Offers New Affordable Interventional Technology

VIDEO: Walk Through of the Henry Ford Hospital Structural Heart Cath Lab

Recently Introduced Angiography Imaging Technology

360 Degree View During a CTO Case at the University of Colorado Hospital

VIDEO: Reducing Cath Lab Radiation Dose at Henry Ford Hospital

Philips Developing X-ray Free Cath Lab Imaging to Replace or Supplement Angiography

Medical Imaging Radiation Levels in U.S. Dropped Over Past Decade

November 14, 2025

November 14, 2025