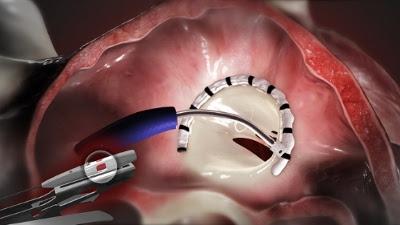

An illustration of how the transcatheter Cardioband System can used as a non-surgical form on annuloplasty repair.

December 2, 2016 — Edwards Lifesciences Corp. announced this week it has agreed to acquire Valtech Cardio Ltd., a privately held company based in Israel and developer of the Cardioband System for transcatheter repair of the mitral and tricuspid valves. The acquisition will give Edwards access to the Cardioband Reconstruction System (Cardioband) for transcatheter repair of the mitral valve and tricuspid valve of the heart. The device technology simulates surgical annuloplasty repairs that reconfigure the shape of the valve annulus to reduce or eliminate valve regurgitation.

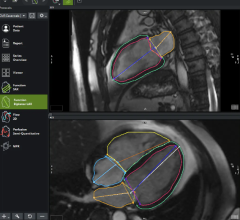

The system utilizes a catheter inserted into the femoral vein and delivered through a transseptal approach across the septum of the heart. The direct annuloplasty system features a unique segmental deployment that conforms to each patient's specific annular geometry, addressing the needs of patients with functional mitral regurgitation. In 2015, the Cardioband transseptal mitral repair system received CE mark approval for European sales. Valtech has also initiated a CE mark trial for the tricuspid application of a similar version of this device, which is intended to reduce tricuspid regurgitation.

"As we continue to pursue multiple therapies to address the diverse needs of patients affected by heart valve disease, we saw an important opportunity to incorporate Valtech's technologies into our comprehensive heart valve repair and replacement portfolio," said Michael A. Mussallem, Edwards' chairman and CEO. "We recognize that physicians will likely need a toolbox of options to treat their patients most effectively. We are very pleased with the progress and future prospects of the multiple internal programs we have underway, and we believe the addition of Valtech's talented team and mitral and tricuspid technologies will present even more opportunities to help patients."

The purchase price of Valtech is $340 million in stock and cash at closing, with the potential for up to $350 million in additional pre-specified milestone-driven payments over the next 10 years. Prior to the close of the transaction, which remains subject to customary closing conditions and is expected in early 2017, Valtech will spin off its early-stage transseptal mitral valve replacement technology program. Edwards will retain an option to acquire that program and its associated intellectual property.

"We are pleased that Edwards, a global leader in patient focused medical innovations for structural heart disease, has elected to include in its growing portfolio of transcatheter based therapies, the Cardioband system for both mitral and tricuspid valve repair. We believe this will position Cardioband to achieve its full potential as a fundamental breakthrough in the way patients are treated for both mitral and tricuspid regurgitation" said Amir Gross, founder and CEO of Valtech. "On behalf of the entire Valtech organization, I want to thank the many physicians who supported us over the past ten years in the development of the Cardioband platform.”

Prior to the closing, Valtech will spin out its early stage Cardiovalve program, and as part of the agreement, Edwards will retain an option to acquire the Cardiovalve program at a later date. Cardiovalve is a transcatheter, transseptally delivered, low-profile, mitral valve replacement (TMVR) system following the Valtech way of delivering surgical based solutions without the risk of surgery. The Cardiovalve platform has an orientation-indifferent structure for reduced implant complexity and was designed from inception to enable transseptal delivery.

Separately, Edwards' Board of Directors has authorized a new share repurchase program to acquire up to an additional $1 billion of the company's outstanding common shares. Edwards also has $277 million remaining of its current $750 million share repurchase program, which was authorized in July 2014. This authorization enables the company to repurchase shares to offset the dilution of the Valtech transaction, and continue executing its share repurchase strategies.

Edwards will provide financial guidance for 2017 and discuss the Valtech transaction further at its annual Investor Conference on Dec. 8.

The Cardioband System is not approved for sale in the United States.

For more information: www.Edwards.com, www.valtechcardio.com

November 14, 2025

November 14, 2025